QRIS Indonesia, the national standard for digital payments, was unexpectedly criticized by U.S. President Donald Trump through the latest National Trade Estimate Report 2025 by the Office of the U.S. Trade Representative (USTR).

The report states that QRIS restricts access for international stakeholders, particularly U.S.-based firms, leading to unfair competition in Indonesia’s digital payments market.

The USTR also included the National Payment Gateway (GPN) in its list of concerns, citing a lack of transparency, mandatory local data processing, and foreign ownership limitations.

These systems are viewed by the U.S. as discriminatory and potentially disruptive in tariff negotiations.

Domestically, QRIS simplifies access to digital payments for micro, small, and medium enterprises (MSMEs).

The system closes service gaps that global players like Visa and Mastercard have not addressed for smaller merchants.

QRIS Sees Rapid Growth in Transactions and Adoption

QRIS usage surged in 2024, reaching a total transaction value of IDR 242 trillion—a 188% increase from the previous year.

Transaction volume hit 2.2 billion, up 190% year-on-year. By Q1 2025, Bank Indonesia recorded 2.6 billion transactions worth IDR 262 trillion.

The spike reflects Indonesia’s expanding digital economy. Convenience and usability are key factors.

According to a 2024 Populix survey cited by Statista, 49% of Indonesians favor QRIS for its ease of use, followed by 42% who value transaction speed.

Promotions (33%), a shift away from cash (28%), broad merchant coverage (23%), and perceived security (22%) also contribute to QRIS’s appeal.

Cost Advantage and Simplicity Drive Merchant Adoption

Compared to card-based systems, QRIS offers significant advantages for sellers. Payment via card requires an EDC machine, costing between IDR 3–5 million.

QRIS, by contrast, operates through a printed QR code, with no device rental needed.

Transaction fees for QRIS are lower, around 0.3% and 0% for micro-merchants compared to 2–3% for card-based transactions.

QRIS is also compatible with all major Indonesian e-wallets and several ASEAN-based platforms.

According to the Indonesian Payment System Association (ASPI), QRIS is now the dominant digital payment method for domestic transactions, while Visa and Mastercard remain more common in international payments.

International Expansion at Risk Due to U.S. Classification

Despite QRIS being designed in line with EMVCo standards used by Europay, Mastercard, and Visa, the USTR argues that international views were not adequately considered during its development.

However, these global companies are also ASPI members and were involved in drafting QRIS with Bank Indonesia and the government.

Labeling QRIS a trade barrier may hinder its adoption in countries beyond Southeast Asia.

Although it is already integrated with Singapore, Malaysia, and Thailand, plans to expand into Japan, South Korea, India, and China may stall due to potential diplomatic concerns with the U.S.

QRIS was developed to support MSMEs in handling domestic and cross-border transactions. The U.S. label could complicate their efforts to expand internationally.

Negotiation Window Offers Strategic Opportunity

The impact of U.S. claims will depend on how the Indonesian government handles ongoing negotiations.

While the U.S. has proposed a 32% import tariff on items such as shoes, textiles, and nickel components, implementation has been paused until July 2025.

Indonesia has a 60-day window to respond.

Minor adjustments to QRIS rules could be exchanged for broader benefits, such as reduced tariffs or new American investment in financial technology sectors.

Bank Indonesia has stated, “If America is ready, we are ready,” and is open to publishing clearer English-language guidelines.

Sharing QRIS’s success, which now supports 56 million users and more than 33 million merchants, could further emphasize its value and interoperability, as seen in its integration with neighboring payment systems.

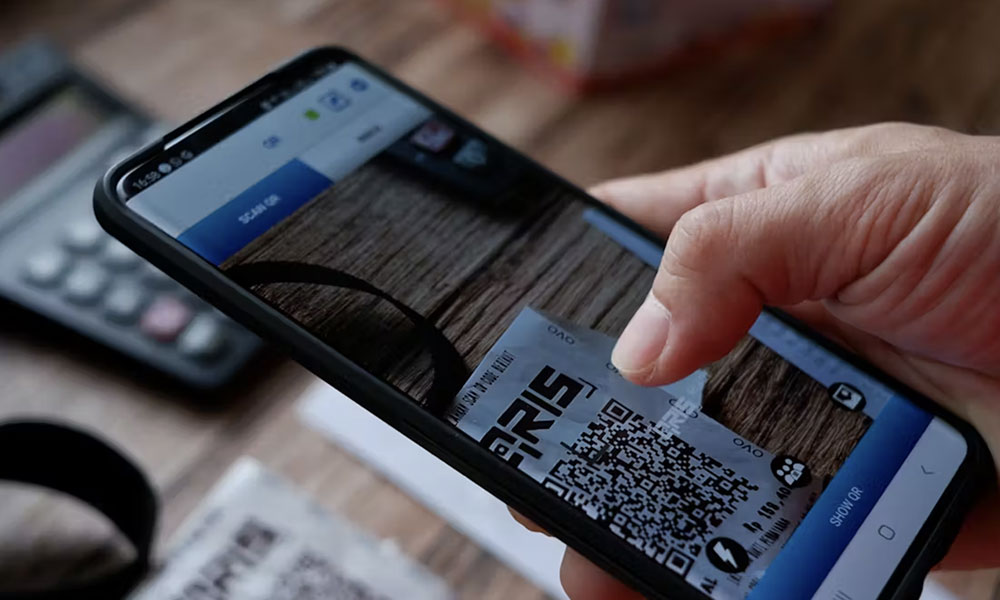

PHOTO: QRIS

This article was created with AI assistance.

Read More

Tuesday, 03-03-26

Tuesday, 03-03-26