PT Bank Central Asia Tbk (BCA) and PT Manulife Aset Manajemen Indonesia (MAMI) have launched the Manulife Liquid Fund USD Class A, a money market mutual fund denominated in U.S. dollars.

Introduced on June 3, 2025, the product is aimed at providing stable capital growth and high liquidity for investors seeking short-term financial solutions.

The fund invests exclusively in USD-denominated financial instruments with maturities of less than one year, such as deposits, bonds, and similar assets.

It is positioned as a flexible solution for asset and currency diversification. It can be redeemed at any time, with no purchase or redemption fees.

Strengthening Investment Product Offerings Through Strategic Collaboration

BCA Director Haryanto T. Budiman stated that the launch reflects the bank’s ongoing efforts to meet the needs of a broad customer base through quality investment products.

“Our commitment is to continually provide financial products relevant to the needs of various customer segments. MAMI has been a strategic partner in delivering quality mutual funds, and we are proud to collaborate once again on the launch of Manulife Liquid Fund USD Class A. The presence of this fund at BCA is expected to expand USD-based investment options for customers, offering an attractive alternative for those prioritizing stability with optimal return potential. We believe this collaboration will also support financial inclusion by providing broader access to professionally and transparently managed investment products.”

Responding to Rising Investor Interest and AUM Growth

The fund’s introduction is aligned with increasing interest in capital markets across Indonesia.

As of March 2025, the number of capital market investors had grown by more than 20% year-on-year, and BCA’s managed funds for investment products increased by over 30% year-on-year during the same period.

This development prompted BCA to collaborate with MAMI to strengthen its portfolio of investment offerings.

Supporting Diversification for USD-Focused Investors

MAMI CEO and President Director Afifa noted that the fund meets the need for liquidity and value preservation in USD.

“We are very enthusiastic to continue our collaboration with BCA in providing a variety of quality investment choices for customers. Adding another investment solution to BCA, the Manulife Liquid Fund USD Class A is a USD-denominated mutual fund designed for short-term goals, where capital liquidity and the ability to preserve USD savings value are essential. Moreover, for investors who already hold USD equity and bond mutual funds, this product serves as a diversification alternative that helps mitigate risks and balances their portfolio through stable performance during market volatility. I believe this strong collaboration presents valuable opportunities for investors in Indonesia.”

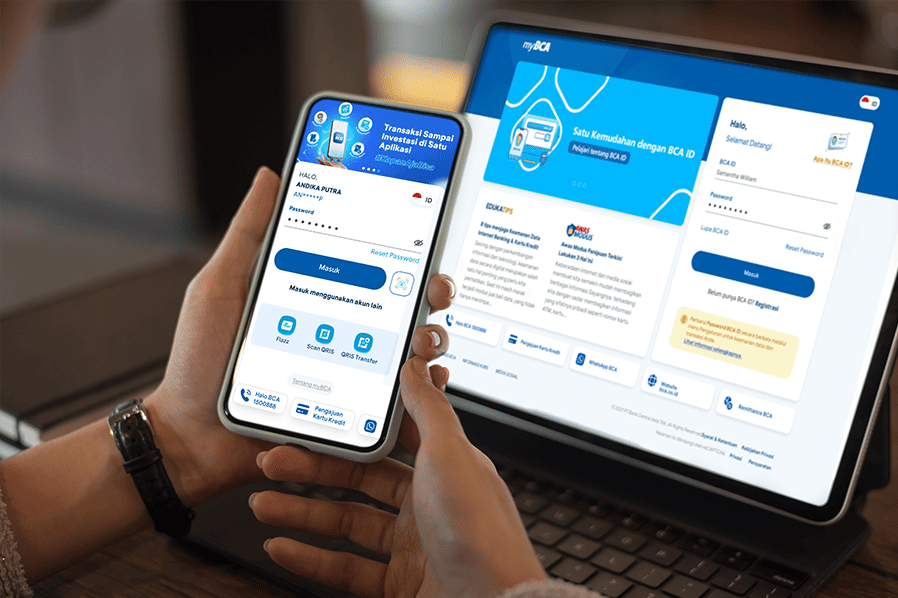

Available Through BCA Branches and myBCA Application

The Manulife Liquid Fund USD Class A is available for a minimum investment of USD 100 at BCA branches that offer mutual fund services.

For customers who have previously invested in USD mutual funds, purchases can also be made directly through the Investasi feature in the myBCA mobile application.

BCA continues to develop the myBCA platform by offering integrated banking and investment services. The app allows users to buy and sell mutual funds, bonds, and government securities (SBN), compare products, manage investment portfolios, access market updates, receive investment maturity notifications, explore educational materials, and take advantage of promotional investment offers.

PHOTO: BCA

This article was created with AI assistance.

Read More

Saturday, 31-01-26

Saturday, 31-01-26