On January 27, 2025, Nvidia experienced an unprecedented decline in its stock value, plummeting nearly 17% and resulting in a market capitalization loss of approximately $600 billion. This event marks the largest single-day loss in market value in U.S. history.

The catalyst for this dramatic downturn was the emergence of DeepSeek, a Chinese artificial intelligence (AI) startup. DeepSeek recently unveiled its AI assistant, R1, which has rapidly gained traction, surpassing OpenAI's ChatGPT to become the top free application on Apple's App Store in the United States. The company's innovative approach has raised concerns among investors about potential disruptions in the AI sector.

DeepSeek's R1 model has been lauded for its efficiency and cost-effectiveness. The company reported spending only $5.6 million to train its V3 model, from which R1 was adapted. This figure stands in stark contrast to the substantial investments made by U.S. companies like OpenAI and Oracle, which have poured hundreds of billions of dollars into AI development.

The market's reaction to DeepSeek's advancements was swift and far-reaching. Nvidia, known for its significant role in supplying AI chips, saw its stock price drop to $118.58, marking its worst day in the market since March 2020. This decline not only affected Nvidia but also led to a broader selloff in the tech sector, with companies such as Microsoft, Alphabet, and AMD experiencing notable stock decreases.

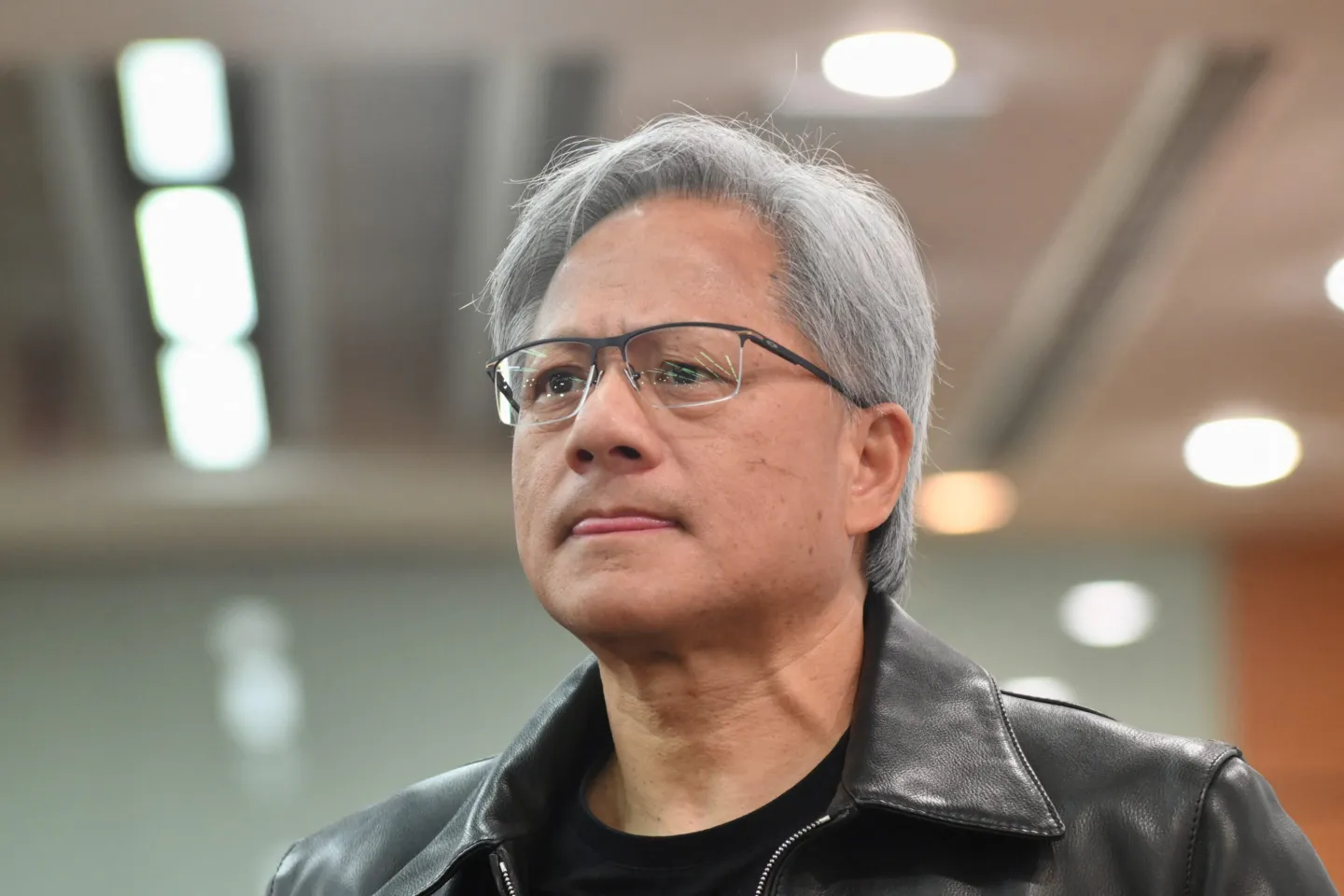

The impact on Nvidia's leadership was significant. CEO Jensen Huang's net worth decreased by approximately $21 billion, bringing his total wealth to around $103.6 billion. This represents a 16.74% reduction in his personal fortune in a single day.

Analysts are divided on the long-term implications of DeepSeek's emergence. Some view the development as a potential threat to established AI companies, given DeepSeek's ability to produce competitive AI models at a fraction of the cost. Others argue that the market's reaction may be overblown, noting that DeepSeek's models still rely on hardware produced by companies like Nvidia. Additionally, there are questions about potential breaches of U.S. export regulations, as DeepSeek's advancements could have been achieved using technology subject to trade restrictions.

The U.S. government is now reassessing its AI policies in light of DeepSeek's rapid ascent. The development has prompted discussions about the effectiveness of current export controls and the need to balance protective measures with the promotion of domestic innovation. The situation underscores the intensifying competition between U.S. and Chinese entities in the AI sector, with potential implications for global technological leadership.

In conclusion, Nvidia's historic market value loss highlights the disruptive potential of emerging AI technologies and the shifting dynamics within the tech industry. As companies like DeepSeek continue to innovate, established firms and policymakers alike must navigate the challenges and opportunities presented by rapid advancements in artificial intelligence.

Read More

Friday, 27-02-26

Friday, 27-02-26