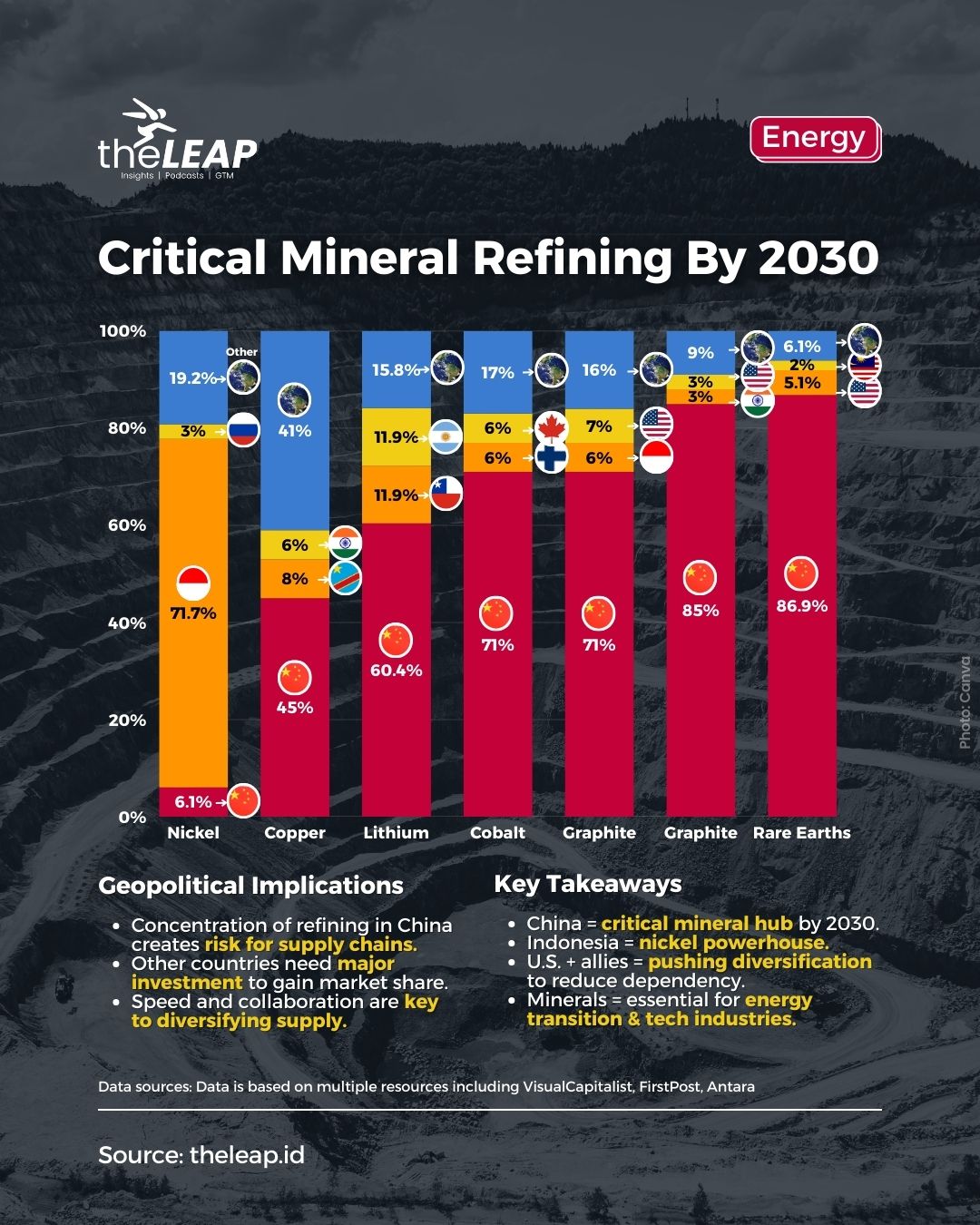

China is projected to control nearly 60% of global refined critical mineral supply by 2030, according to data from Benchmark Mineral Intelligence and the International Energy Agency (23/12).

The projection highlights China’s dominant position in refining lithium, rare earth elements (REEs), cobalt, and graphite, which are essential for energy transition technologies and strategic industries.

The concentration of refining capacity in one country may deliver cost efficiencies, but it also increases geopolitical risks for countries dependent on these supply chains.

Indonesia Emerges as the Leading Refiner of Nickel

Nickel is the only critical mineral where China is not expected to lead by 2030. Indonesia is projected to command 71.24% of the global refined nickel supply, while China’s share is forecast at 6.24%.

Indonesia’s dominance is linked to its large nickel ore reserves, expansion of low-cost refining facilities, and a ban on raw ore exports.

Russia is expected to hold 3.26%, with other countries collectively accounting for 19.27% of the refined nickel supply.

Projected Refining Shares Show China’s Broad Control

China is expected to control 44.63% of copper refining, 60.86% of lithium, 86.11% of rare earth elements, 71.42% of cobalt, and more than 85% of synthetic graphite by 2030. Natural graphite refining in China is projected at 70.50%.

Other countries maintain smaller shares across several minerals.

Chile and Argentina are each projected to hold around 11.6% of lithium refining, while the United States is expected to account for 5.14% of REE refining and 7.22% of natural graphite.

Copper Refining Remains More Diversified Globally

Copper refining shows a more fragmented global landscape compared to other critical minerals. China’s projected share stands at 44.63%, while other countries collectively account for 40.99%.

The data also shows Finland and Canada holding notable shares in cobalt refining at 5.87% and 5.73%, respectively.

These contributions remain significantly smaller than China’s overall refining capacity across most critical minerals.

US and Indonesia Take Steps to Access Critical Minerals

The United States is expected to urge G7 countries and key partners to reduce dependence on China for critical minerals (11/01).

US Treasury Secretary Scott Bessent will convene senior finance officials from the G7, the European Union, Australia, India, South Korea, and Mexico to discuss faster progress in supply chain diversification.

Meanwhile, Indonesia’s sovereign wealth fund, Danantara, has begun talks with the US to allow access to its critical minerals sector (26/12).

Coordinating Minister Airlangga Hartarto confirmed that US companies are engaging with Indonesian firms to support industries such as automotive, aviation, and defense.

This article is a summary of several original articles. The full versions can be read at the following links:

https://www.visualcapitalist.com/china-still-dominates-critical-mineral-refining-in-2030/

https://www.firstpost.com/world/us-to-urge-g7-and-partners-to-cut-reliance-on-china-for-critical-minerals-ws-e-13967628.html#goog_rewarded

https://en.antaranews.com/news/397807/indonesias-danantara-in-talks-on-us-access-to-critical-minerals

This article was created with AI assistance.

We make every effort to ensure the accuracy of our content, some information may be incorrect or outdated. Please let us know of any corrections at [email protected].

Read More

Wednesday, 28-01-26

Wednesday, 28-01-26