Nvidia’s Q3 2025 earnings call sent a strong signal to markets: despite concerns about an AI bubble, the company continues to execute at a blistering pace, forging major partnerships, expanding infrastructure, and sharpening its long-term vision. Below, we unpack the biggest themes from the earnings call that investors, analysts, and industry watchers should not ignore.

The AI Bubble Debate: Confidence Over Caution

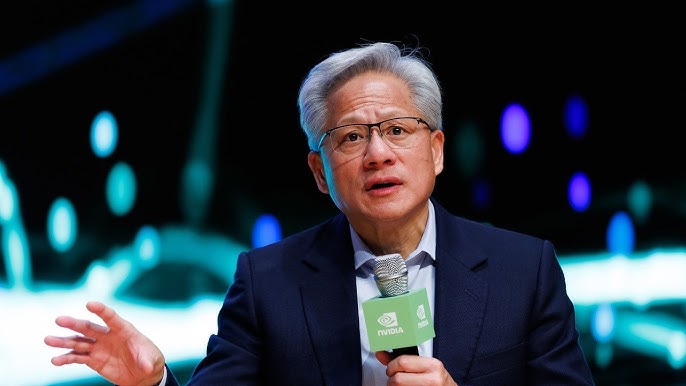

One of the most talked-about aspects of the earnings call was CEO Jensen Huang’s response to growing fears of an AI bubble. Rather than shy away, he leaned into Nvidia’s unique role across multiple stages of AI development, from training large models to inference and deployment. Huang argued that many critics misunderstand the nature of Nvidia’s business: the shift from general purpose CPUs to GPU-accelerated computing is not a speculative bet, but a fundamental transition.

Huang emphasized that Nvidia’s platforms are not only enabling massive AI workloads but also helping monetize AI in new ways. He pointed to agentic AI systems, autonomous agents that can act and learn, as emerging opportunities. These systems, according to him, could power a wave of applications that dramatically increase demand for Nvidia's compute. The clear takeaway: Nvidia is not worried about a short-term hype cycle; it is playing for the long game.

Strategic Partnerships: Fueling AI Scale

Perhaps the most striking part of the earnings call was Nvidia’s announcement of massive strategic partnerships. The company revealed deals with OpenAI, Anthropic, xAI, and Uber, signaling its central role in the future of large-scale AI infrastructure. With OpenAI, Nvidia plans to deploy at least 10 gigawatts of its systems to support next-generation AI models. The company could invest up to 100 billion dollars into this infrastructure over time.

With Anthropic, Nvidia pledged up to 10 billion dollars in funding, reinforcing its deep technology partnership. xAI, Elon Musk’s AI company, will be one of the first customers in a major data center in Saudi Arabia loaded with Nvidia chips. There is also a collaboration with Uber around autonomous systems, leveraging Nvidia’s robotics and AI architecture. These deals are not just symbolic. They represent Nvidia’s commitment to massively scale AI infrastructure and to be deeply embedded in its customers’ compute roadmap.

Geopolitical and China Market Challenges

Despite its growth, Nvidia did not hide from risk. The earnings call underscored persistent geopolitical headwinds, particularly around United States export restrictions to China. Nvidia CFO Colette Kress expressed disappointment that export rules continue to limit its ability to ship advanced AI hardware to Chinese customers.

Nvidia reported virtually zero compute or data center revenue from China in Q3, and it forecasted no such revenue for Q4 either. This cautious outlook signals that while China remains important for Nvidia, regulatory barriers could significantly dampen near-term opportunity there.

Yet, Nvidia stated it will continue engaging with regulators on both sides. This suggests the company still sees value in the Chinese market, even though near-term risks are material.

Key Growth Verticals: Robotics, Infrastructure, and Hyperscalers

Beyond chips and code, Nvidia is thinking in terms of ecosystems. It identified robotics and AI infrastructure as key growth vectors. Automotive revenue surged, with Q3 numbers reaching 592 million dollars, a 32 percent increase year over year. This is paired with Nvidia’s ambition to supply 5 million GPUs in aggregate for its AI infrastructure projects, a staggering scale that requires build-out of data centers, power capacity, and cooling.

Hyperscalers are also fundamental to Nvidia’s long-term vision. CFO Kress estimated that companies like Meta could account for nearly half of Nvidia’s long-term opportunity. These customers are shifting more of their workloads to accelerated computing and generative AI, driving demand for Nvidia’s platform. On the software front, Nvidia continues to lean into its ecosystem advantage. Its CUDA software, AI enterprise stack, and other frameworks remain a competitive edge enabling developers and companies to build highly optimized AI systems.

Financial Performance: Record Revenue and Bullish Guidance

The financials backed up Nvidia’s strategic narrative. In Q3 2025, Nvidia posted 57 billion dollars in revenue, significantly beating analyst expectations. Remarkably, the data center division alone contributed 51 billion dollars, underscoring just how central AI infrastructure has become to Nvidia’s business. Gross margins stayed robust, supported by the data center mix and cost efficiencies, even as Nvidia scales its newer architectures. Nvidia also raised its Q4 guidance to 65 billion dollars in revenue, signaling strong confidence in sustained demand.

Risks and Long-Term Considerations

While the quarter was blockbuster, not everything is smooth sailing. The China export risk is significant and could limit part of Nvidia’s addressable market. There is also the challenge of scaling infrastructure: building data centers at the scale Nvidia envisions is not trivial. Power, cooling, and supply chain constraints may pose bottlenecks. Additionally, as Blackwell GPU production ramps, Nvidia may face initial margin pressures. Several analysts already suggest that gross margins could compress in the near term as costs rise. Competition is also intensifying. Other chip makers and cloud providers are investing heavily in accelerated compute. Nvidia’s partnerships and scale give it a strong position, but it cannot be complacent.

Nonetheless, Nvidia’s long-term thesis remains compelling: it is not just selling chips, but building the backbone of the AI economy.

Why This Matters for Investors and the AI Industry

For investors, Nvidia’s Q3 2025 earnings highlight that the AI boom is far from over, at least for those with infrastructure bets. The strong guidance, major partnerships, and continued dominance in data center compute suggest that Nvidia is well-positioned for the next wave of AI innovation. For the broader AI industry, Nvidia’s scale is enabling the build-out of AI factories, massive compute systems that train, run, and deploy advanced AI models. These systems will power many future applications: generative AI, robotics, autonomous vehicles, and more. And perhaps most importantly, Nvidia’s willingness to invest billions into AI infrastructure with its partners demonstrates a long-term commitment. These are not short-term deals; they are bets on a future where compute is king.

Read More

Monday, 23-02-26

Monday, 23-02-26