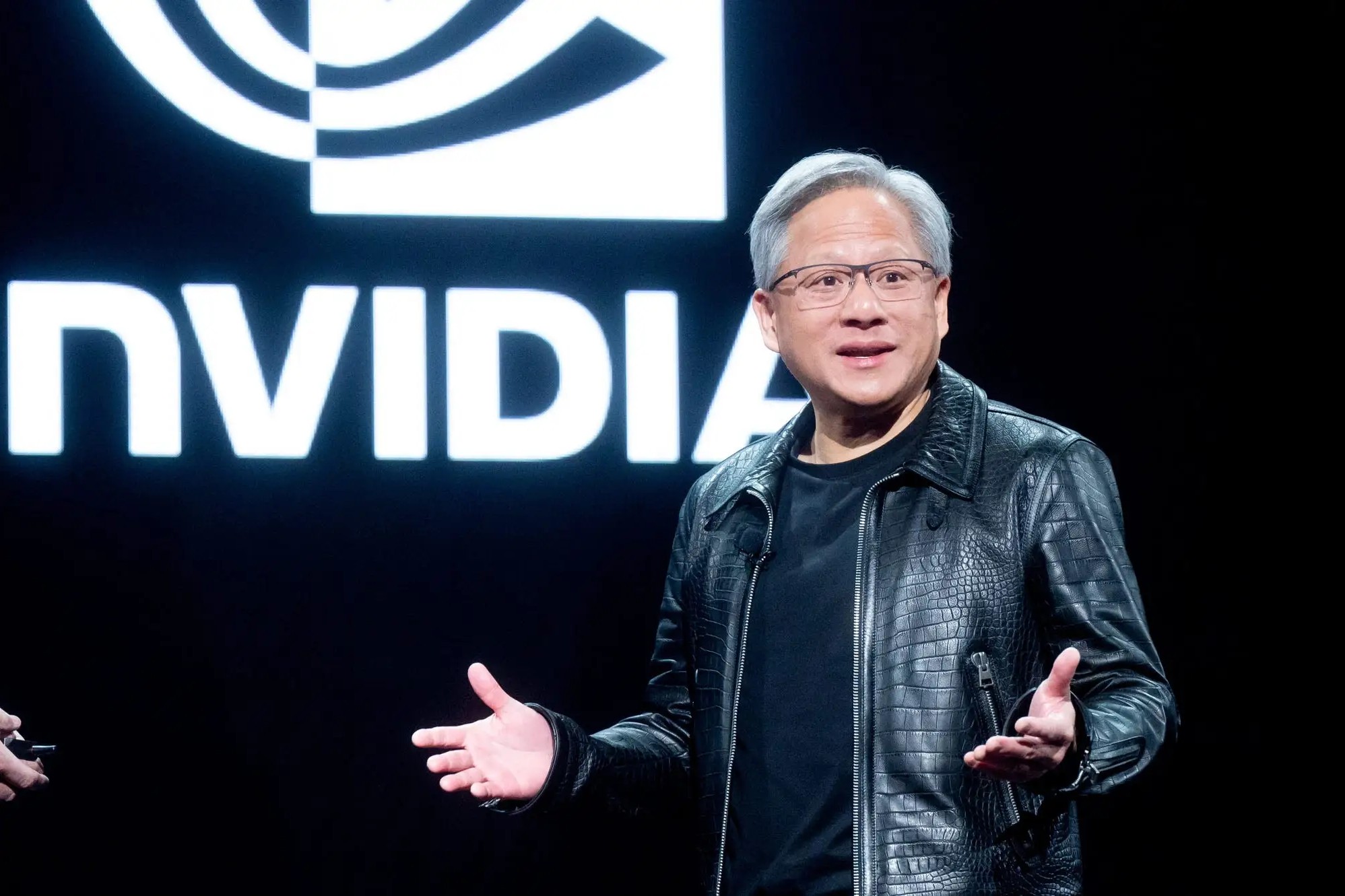

Nvidia CEO Jensen Huang revealed in October that the company has $500 billion in orders for its chips in 2025 and 2026 combined. These chips, including current Blackwell GPUs, next-year Rubin GPUs, and related networking components, are central to the AI boom.

“This is how much business is on the books. Half a trillion dollars worth so far,” Huang said at the GTC conference in Washington. His statement signals confidence in strong growth for the next cycle of chips, even as growth is expected to slow slightly.

Analysts Expect Higher 2026 Revenue Growth

After analyzing Huang’s remarks, analysts concluded that Nvidia’s 2026 revenue could be significantly higher than previously expected. Wolfe Research analyst Chris Caso wrote, “NVDA’s disclosures suggest clear upside to current consensus estimates,” noting that data center sales could exceed prior 2026 estimates by $60 billion.

Nvidia is scheduled to report third-quarter earnings on Wednesday. Analysts polled by LSEG expect $1.25 in earnings per share on $54.9 billion of sales, a 56% year-over-year increase. They also forecast $61.44 billion in revenue for the January quarter, suggesting a reacceleration of growth.

Hyperscalers’ AI Investments Drive Demand

Huang noted that Nvidia has “visibility” into its revenue, reflecting strong demand from major tech companies such as Google, Amazon, Microsoft, and Meta. In October, all of these companies reported increasing capital expenditures on AI infrastructure, driving orders for Nvidia chips.

Oppenheimer analyst Rick Schafer described this as an “insatiable AI appetite,” while noting Nvidia’s AI supply remains below demand.

Strategic Deals with OpenAI, Intel, and Nokia

Nvidia has pursued multiple strategic partnerships during the quarter. The largest deal involves a $10 billion investment in OpenAI equity, in return for 4 million to 5 million GPUs over several years. Nvidia also agreed to invest $5 billion in Intel to optimize Intel chips to work with Nvidia GPUs.

Additionally, Nvidia took a $1 billion stake in Nokia to integrate its GPUs into the company’s cellular network hardware. Citi analyst Atif Malik said the OpenAI deal is expected to be a key topic for investors during the earnings call.

China Market Remains a Key Uncertainty

Nvidia’s AI GPU market share exceeds 90%, but potential sales to China remain uncertain. The company’s H20 chip faces export restrictions, and no successor has been announced. Schafer said China could represent over $50 billion in annual revenue.

When asked by CNBC whether he wants to sell current Blackwell-generation chips to China, Huang said, “I hope so. But that’s a decision for President Trump to make.”

PHOTO: GETTY IMAGES/NOAH BERGER

This article was created with AI assistance.

Read More

Friday, 27-02-26

Friday, 27-02-26