Indonesia’s economic fundamentals remain solid as the country enters 2026, with manufacturing activity showing recovery at the end of 2025, reflected in five consecutive months of expansion in the Purchasing Managers' Index (PMI) (27/01).

In line with this economic momentum, Bank Mandiri, as a strategic partner of the government, continues to strengthen its contribution through cross-sector digital collaborations, particularly via its flagship service, Kopra by Mandiri.

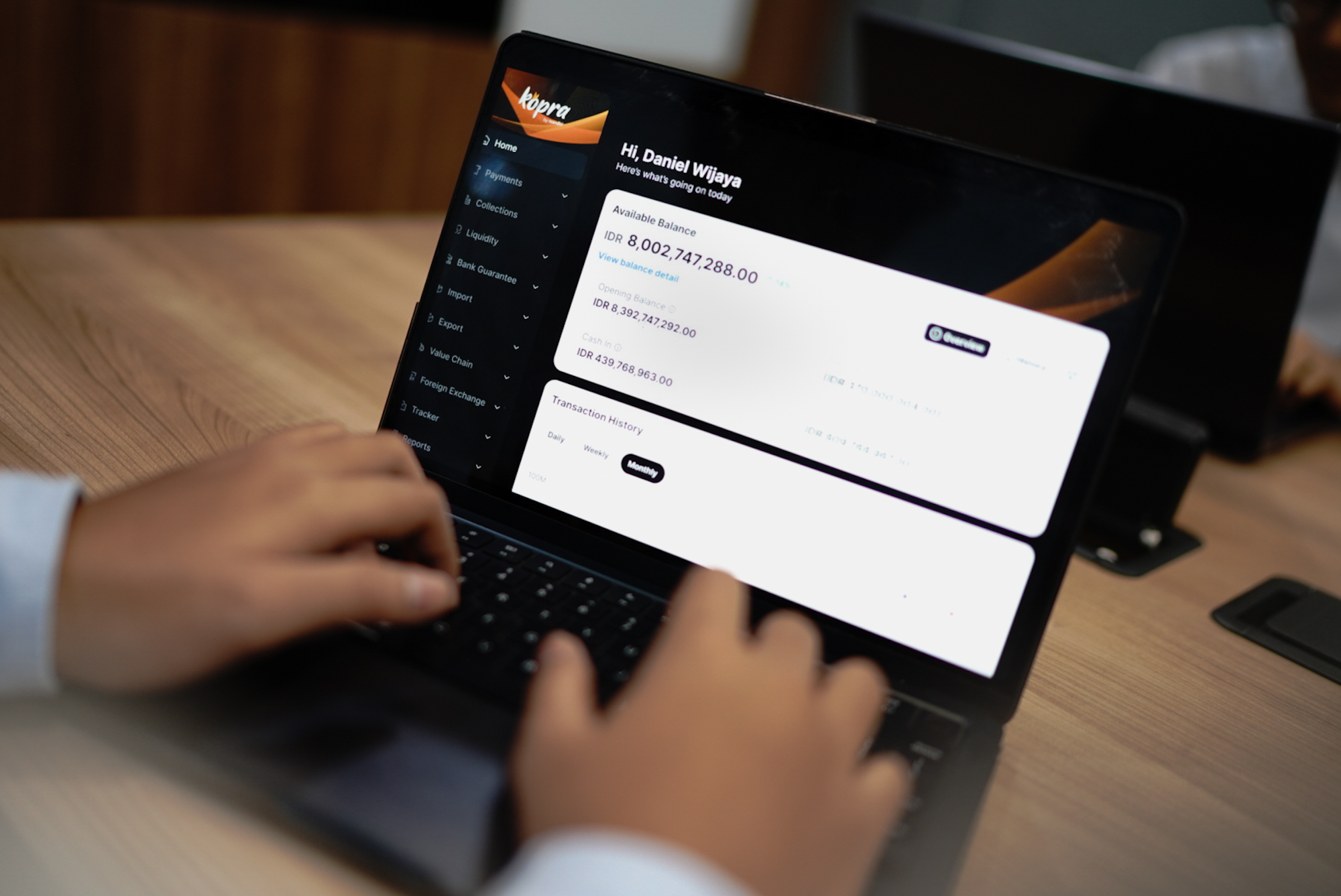

Kopra by Mandiri Boosts Efficiency Through Integrated Digital Services

Bank Mandiri CEO Riduan stated that the company consistently develops the Kopra ecosystem to support wholesale transaction needs amid dynamic economic activity.

“Bank Mandiri continues to strengthen digital transformation through Kopra by Mandiri to drive cross-sector collaboration, improve wholesale service efficiency, and support sustainable national economic growth,” he said.

Kopra by Mandiri offers accelerated digital banking services with three main features Cash Management, Value Chain, and Trade, accessible through a single sign-on system.

These solutions help businesses manage cash flow, supply chain financing, and commercial transactions more efficiently, enhancing operational effectiveness and competitiveness.

Supporting Businesses Across Sectors with Tailored Digital Features

Kopra continuously develops features to meet evolving business needs, including operational support, liquidity management, and informed business decision-making.

In international trade, Kopra provides integrated solutions for managing foreign exchange from natural resource exports (DHE SDA).

Additionally, Bank Mandiri offers the Kopra Collateralized Deposit Loan (KAD), allowing clients to apply for loans using existing deposits as collateral.

Beyond serving large corporations, Kopra also supports businesses connected within corporate value chains.

Features such as electronic invoice presentment & payment (EIPP), as well as tax and billing payment services, help businesses manage transactions transparently and efficiently.

Kopra Shows Positive Growth Metrics

The platform has shown consistent growth. By the end of November 2025, Kopra’s transaction value reached IDR 26,634 trillion, up 22% year-on-year, with transaction volume at 1.36 billion, a 14% increase. Its user base has also grown steadily, exceeding 300,000 users.

Commitment to Ongoing Digital Innovation

Riduan added that Bank Mandiri is committed to continuously developing digital services relevant to customer needs, contributing to sustainable economic growth.

“Through strengthening Kopra by Mandiri, the bank is confident that cross-sector synergy can act as a catalyst in maintaining economic growth momentum,” he concluded.

PHOTO: BANK MANDIRI

This article was created with AI assistance.

We make every effort to ensure the accuracy of our content, some information may be incorrect or outdated. Please let us know of any corrections at [email protected].

Read More

Wednesday, 28-01-26

Wednesday, 28-01-26