Indonesia is moving fast toward a more cashless future, and one of the most visible shifts this year is the rollout of QRIS Tap. GoPay QRIS Tap puts contactless NFC payments into the pockets of millions of commuters and everyday shoppers, and early usage data suggests the change is already meaningful. Bank Indonesia has reported that QRIS Tap is seeing tens of thousands of transactions on a weekly basis, a sign that the new payment method is gaining traction in real-world settings.

Adoption of GoPay QRIS Tap is not only a question of convenience. It is about unifying payment rails, reducing friction in mass transit, and expanding digital payment acceptance to merchants and services that previously relied on cash. This article explains how the feature works, why it matters for Indonesia’s payments landscape, and what the near-term implications are for riders, merchants, and regulators.

How QRIS Tap Works and What GoPay Adds

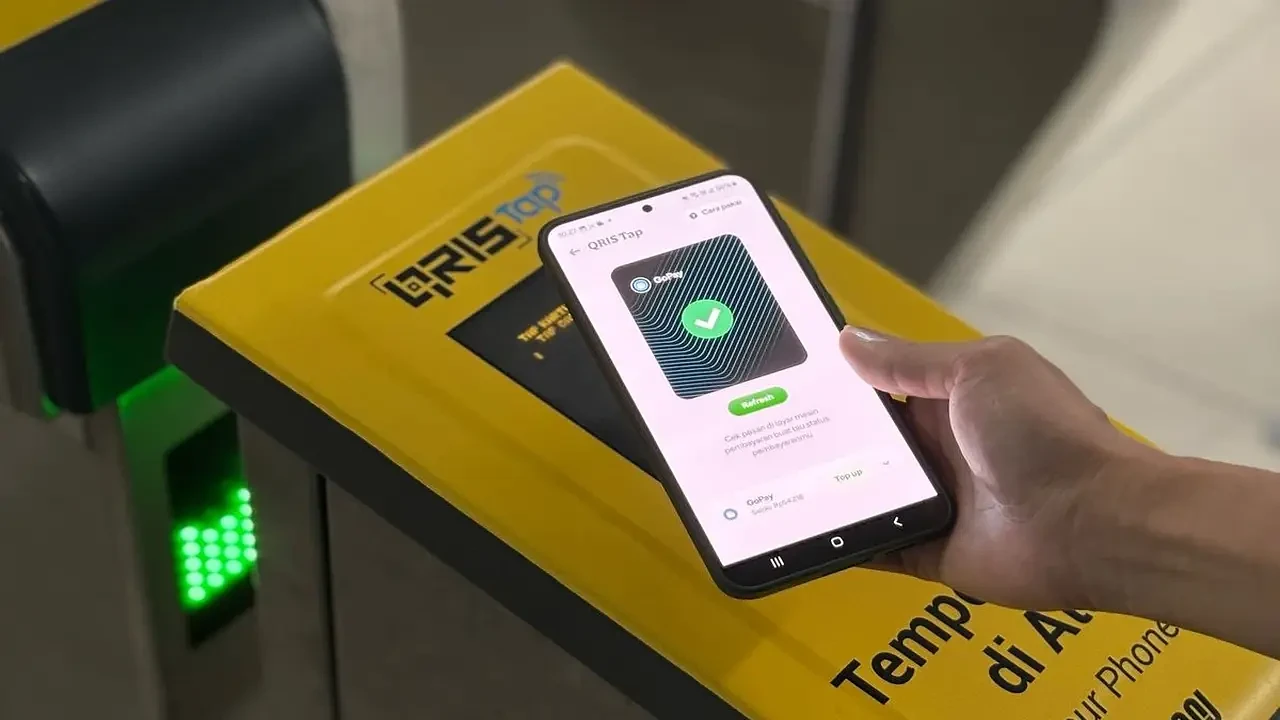

QRIS Tap is the NFC-enabled extension of the existing QRIS standard promoted by Bank Indonesia QRIS. Instead of scanning a visible QR code, users tap an NFC-enabled Android phone to a reader and the payment is processed in milliseconds. Because the implementation currently relies on open NFC access that Android devices provide, initial rollouts focus on Android phones. Apple devices are not broadly supported at the same stage.

GoPay implemented GoPay QRIS Tap inside its app to let users pay by tapping their phones at compatible terminals. The experience mirrors other contactless payment options but uses the national QRIS standard, enabling interoperability with many merchants and transport operators that adopt QRIS Tap. GoPay’s own announcements describe the feature as designed for fast and mass-use scenarios such as public transport, small retail, and parking.

Why This Matters for Transport and Daily Commuting

Public transport environments demand speed and reliability in fare collection. Physical ticketing and slow QR scans create bottlenecks at peak times. QRIS Tap, and GoPay NFC payments in particular, aim to reduce dwell time by enabling near-instant tap-in and tap-out. Early pilot projects, including limited tests on MRT Jakarta and other transport pilots, show the potential to match or beat traditional card-based contactless fares in speed and reliability.

For commuters this means a simpler experience. Instead of carrying a payment card or fumbling with a QR scan, riders can rely on the phone they already carry. For operators, the ability to accept GoPay QRIS Tap and other QRIS Tap-enabled wallets reduces the need for multiple fare devices and simplifies back-end reconciliations when implemented correctly.

Regulatory and Industry Support

Bank Indonesia has been actively pushing the QRIS Tap standard as part of a broader blueprint to modernize Indonesia’s payment system. The central bank’s published rollout numbers show a rapid expansion of QRIS Tap acceptance points and rising user counts, which reinforces the strategic push to use QRIS as a nationwide digital payment standard. The central bank’s involvement gives merchants and payment providers a clearer interoperability target.

Antara and other official reports list several banks and e-wallet providers already participating in QRIS Tap initiatives, including GoPay, ShopeePay, Dana, and others. This broad provider base is important because QRIS Tap’s success depends on network effects: the more wallets and banks that support it, the more compelling it is for merchants to enable NFC readers.

Benefits Beyond Speed: Inclusion and Merchant Economics

Contactless payments Indonesia can benefit smaller merchants and informal vendors. QRIS Tap supports low-value, high-frequency transactions without the friction of handling cash or scanning codes, making digital acceptance more practical in markets, stalls, and small retail outlets. Merchants that adopt NFC readers compatible with QRIS Tap can serve more customers faster and potentially reduce cash handling costs.

For digital wallet providers such as GoPay, integrating QRIS Tap can deepen user engagement. Users who make daily commuting payments with GoPay are more likely to top up balances, use promotions, and adopt other in-app financial services. GoPay has used promo campaigns and coin cashback incentives to drive early adoption, which helps bootstrap daily usage and habituate users to the new flow.

Challenges and Practical Limitations

Despite positive indicators, several challenges remain. First, QRIS Tap’s current Android-first availability limits universal adoption because a segment of the population uses iPhones. Without broad iOS support, network coverage will vary and some commuters will still need cards or alternate wallets. Bank Indonesia and industry stakeholders must negotiate with device vendors and operating system providers to expand reach.

Second, hardware rollout is nontrivial. Transport operators and merchants must either retrofit existing terminals with NFC-compatible readers or procure new devices. The upfront cost and integration effort can be a barrier for smaller merchants. Incentives and low-cost reader programs will be important to accelerate merchant acceptance.

Third, user education and trust remain critical. To shift cash habits at scale, riders and shoppers need clear guidance on how to set up GoPay QRIS Tap, manage balances, and troubleshoot failed transactions. Promotions help, but sustained user support and clear app UX are essential for long-term retention.

What To Watch Next

Over the coming months, industry watchers should track several indicators to measure the momentum of GoPay QRIS Tap and QRIS Tap more broadly. Key metrics include weekly transaction counts, merchant reader installations, cross-wallet interoperability tests, and any policy changes from Bank Indonesia regarding standardization or incentives. Early signals are encouraging: Bank Indonesia has already highlighted tens of thousands of weekly transactions tied to QRIS Tap usage.

Another important development is cross-border QRIS integration and interconnection trials that Bank Indonesia has discussed for regional expansion. If QRIS standards can interconnect smoothly with neighboring payment rails, the strategic value of national standards like QRIS Tap will increase significantly.

Practical Tips for Users and Merchants

For users:

• Make sure your Android phone’s NFC is enabled.

• Update the GoPay app and enable the QRIS Tap option.

• Keep a small backup balance for commuting during the first weeks of adoption.

• Look out for GoPay promos that can reduce the effective cost of trial transactions.

For merchants and transport operators:

• Evaluate the cost and compatibility of NFC readers with existing fare systems.

• Coordinate with wallet providers and banks to enable reconciliation and settlement.

• Offer clear signage and staff training during the transition window to minimize passenger confusion.

• Consider promotional partnerships with wallets to incentivize early users.

GoPay QRIS Tap is a practical, standards-based step toward faster contactless payments Indonesia-wide. Supported by Bank Indonesia and adopted by multiple e-wallets and banks, QRIS Tap addresses speed and convenience concerns, particularly in transport and high-frequency retail contexts. Early usage metrics and pilot deployments show promising momentum. The next phase of success will depend on expanding device compatibility, scaling merchant hardware, and sustaining user trust through clear UX and incentives. If those pieces fall into place, GoPay QRIS Tap could become a foundational element of Indonesia’s cashless transition.

Read More

Wednesday, 25-02-26

Wednesday, 25-02-26