PT Bank Syariah Indonesia Tbk (BSI) has officially received a license to offer gold savings services, which was obtained on November 10, 2025. With this approval, BSI now operates three bullion business lines: gold savings, gold trading, and gold custody.

Expanding Bullion Services: Savings, Trading, and Custody

Gold savings allow customers to store gold at the bank, which can be used in gold-to-gold financing or gold trading schemes. Custody services provide safe storage with fee-based income for the bank, while trading services involve buying and selling standardized gold bars.

BSI expressed gratitude to President Prabowo Subianto and the Financial Services Authority (OJK) for granting the license. The bank’s bullion business has seen significant growth, supported by increasing customer numbers and transaction volumes.

Affordable and Secure Gold Investment for All Indonesians

BSI Deputy President Director Bob Tyasika Ananta highlighted at Bullion Connect Jakarta that the bullion business “makes gold investment more accessible to all layers of society.” Through BSI’s BYOND mobile app, customers can buy gold starting from Rp50,000, equivalent to 0.02 grams.

Investments can be made 24/7, and gold can be minted in relatively low amounts. “If a customer has 2 grams, they can already print their gold.” Physical gold is stored securely in vaults, ensuring safety. Customers can also sell their gold anytime, with proceeds transferred to accounts in real time.

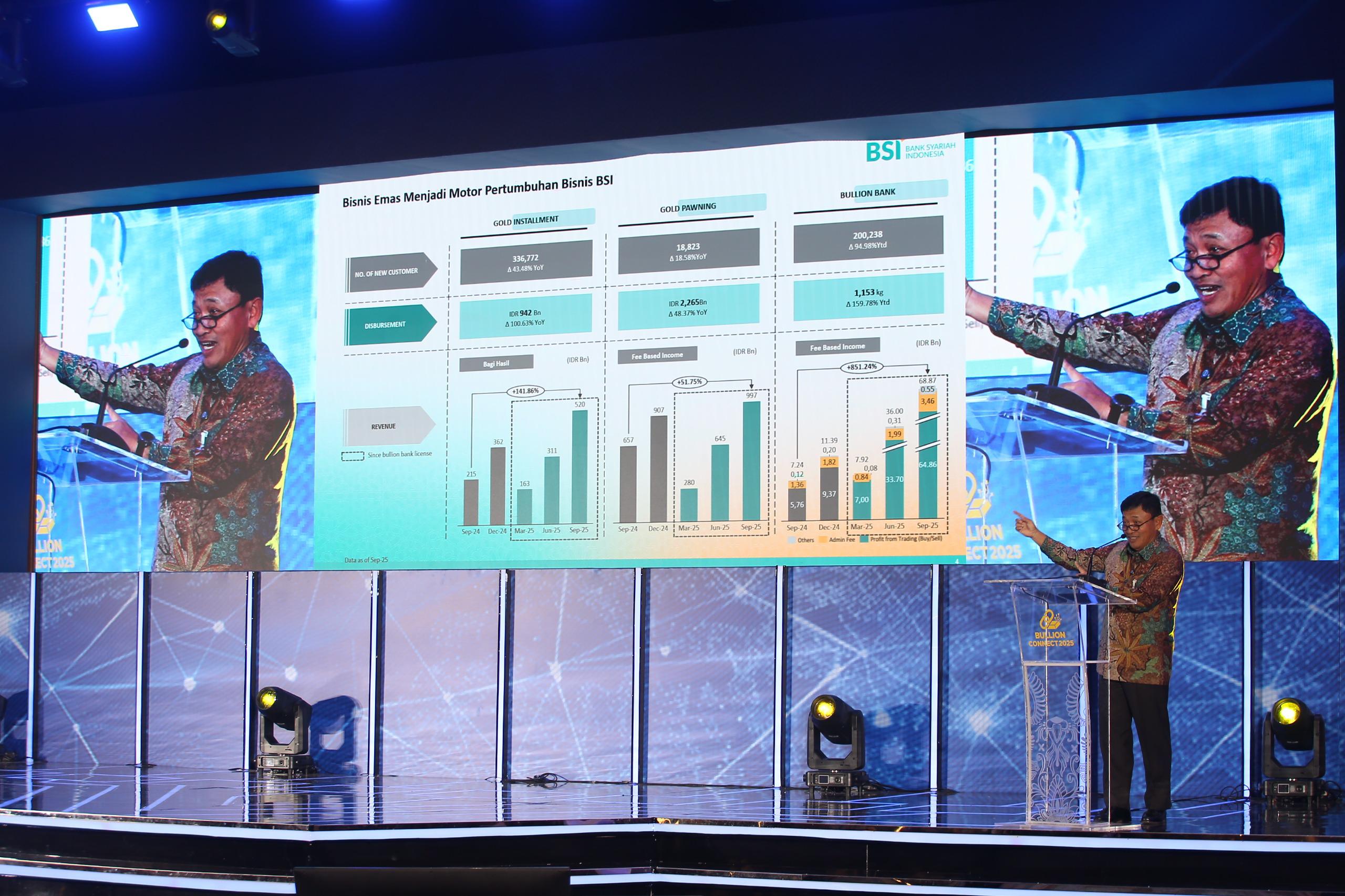

Strong Growth in Customers, Transactions, and Revenue

Since its launch through 30 September 2025, BSI’s bullion services have attracted high customer interest. Accounts holding gold reached 200,238, a 94.98% year-to-date increase. Gold sales via the BYOND app reached 1.06 tons, generating approximately Rp70 billion in fee-based income. Total gold managed rose 159.78% YTD to 1.15 tons, valued at Rp2.55 trillion.

Bullion services have also helped BSI maintain positive growth amid challenges in the banking sector. Net profit through 30 September 2025 reached Rp5.57 trillion, up 9.04% YoY, supported by profit-sharing revenue (+13.90% YoY) and fee-based income (+20.81% YoY), partly driven by bullion operations.

BSI’s assets rose 12.37% YoY to 30 September 2025, fueled by a 15.66% YoY growth in third-party funds (DPK), dominated by low-cost funds (+11.39% YoY). Financing grew 12.65% YoY, aided by the expanding gold business.

BSI’s Bullion Strategy Strengthens Bank Performance

Rising public interest in gold bars also contributed to a 3.64% increase in total gold demand in 2024 compared to 2023. Bob noted, “There are many opportunities to expand Indonesia’s gold market, as per-capita consumer gold ownership is the lowest in Southeast Asia, only 0.17 grams per person.” BSI currently serves 22.6 million customers across 1,039 branches.

The development of bullion services complements BSI’s broader gold ecosystem, which includes gold pawn and installment plans with rapid growth. The bank also plans to collaborate with the National Gold Council and seeks incentives for financial institutions offering bullion services, such as including gold savings in HQLA Level 1 calculations to enhance liquidity and profitability.

BSI continues to innovate through its E-mas service on the BSI Mobile app, enabling customers to buy, sell, transfer, mint, and regularly save gold, simplifying investment access across all segments of society.

PHOTO: BSI

This article was created with AI assistance.

Read More

Friday, 27-02-26

Friday, 27-02-26