As India charts its path toward technological self-reliance and digital transformation, Reliance Industries is leading the charge with its bold Reliance Intelligence AI venture announcement. This strategic move unfolds alongside preparations for the highly awaited Jio IPO and signals a potential turning point in India's industrial and AI ecosystem. This article explores how the Reliance Intelligence AI venture, combined with AI partnerships with Google and Meta, positions India’s mobile carrier IPO efforts and broader digital ambitions on a global trajectory.

The Genesis of Reliance Intelligence AI Venture

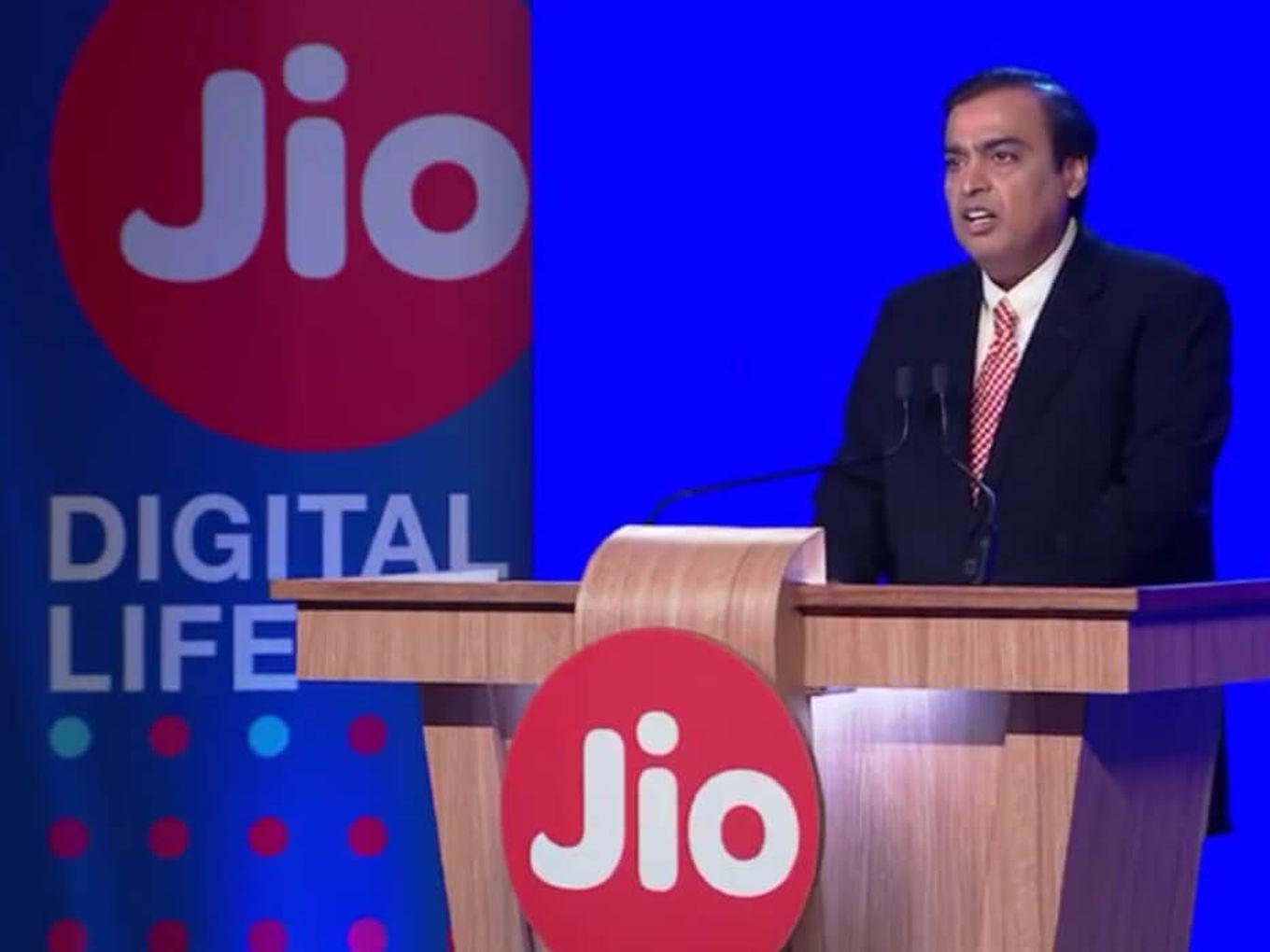

At Reliance Industries’ 48th Annual General Meeting, Chairman Mukesh Ambani introduced the Reliance Intelligence AI venture, a wholly owned subsidiary envisioned to drive AI adoption “everywhere for every Indian.” The launch cements Reliance’s aspiration to replicate the digital transformation it achieved with Jio Platforms a decade ago. The venture includes four core missions: establishing gigawatt-scale AI-ready, green-energy-powered data centers in Jamnagar; forging partnerships with global tech giants; building industry- and consumer-facing AI applications; and creating AI talent hubs of world-class researchers and engineers.

Strategic AI Partnerships with Google and Meta

Emphasizing global collaboration, the Reliance Intelligence AI venture includes two pivotal alliances:

- A partnership with Google, intended to establish a dedicated Jamnagar cloud region—powered by green energy and integrated with Jio’s network.

- A joint venture with Meta, where Reliance holds a 70% stake, investing approximately $100 million to deploy Meta’s open-source LLaMA models as an AI platform-as-a-service for enterprises.

These AI partnerships with Google and Meta reflect Reliance’s ambition to offer customized, scalable AI infrastructure aligned with Indian industry needs.

Jio IPO: A Pivotal Moment for India’s Capital Markets

Parallel to its AI ambitions, Reliance is gearing up for one of India’s largest mobile carrier IPOs. The Jio IPO is expected to occur in the first half of 2026, potentially valuing Jio Platforms at over $100 billion. With over 500 million subscribers, Jio serves as one of the most dominant telecom operators in the world. Despite its scale, some analysts caution about possible execution risks, holding company valuation discounts, and missed value-unlocking opportunities that a demerger might have offered instead.

Converging Visions: AI Infrastructure and IPO Momentum

The simultaneous rollout of the Reliance Intelligence AI venture and the anticipated Jio IPO suggests a calculated synergy. The AI venture not only amplifies Jio’s appeal to global investors but also expands the operational blueprint of Reliance Platforms beyond connectivity into deep-tech services. As investors evaluate the mobile carrier IPO, the added dimension of AI infrastructure and future-ready digital services enhances Jio’s attractiveness as a high-growth asset.

Implications for India’s Tech and Investment Landscape

Reliance’s strategy sets a new precedent in India: combining infrastructure-led IPO execution with foundational AI investments. This model may well influence future public listings and corporate frameworks across Indian conglomerates seeking to leverage innovation and capital markets.

Moreover, the Reliance Intelligence AI venture has the potential to accelerate AI inclusion across sectors—from retail to rural services and governance—aligning with India’s broader digital transformation and self-reliance goals.

In a landscape where AI and digital scale define competitive advantage, Reliance appears to be writing the playbook for how a vision-driven IPO and technology venture can coalesce to shape national and regional progress.

Read More

Thursday, 22-01-26

Thursday, 22-01-26