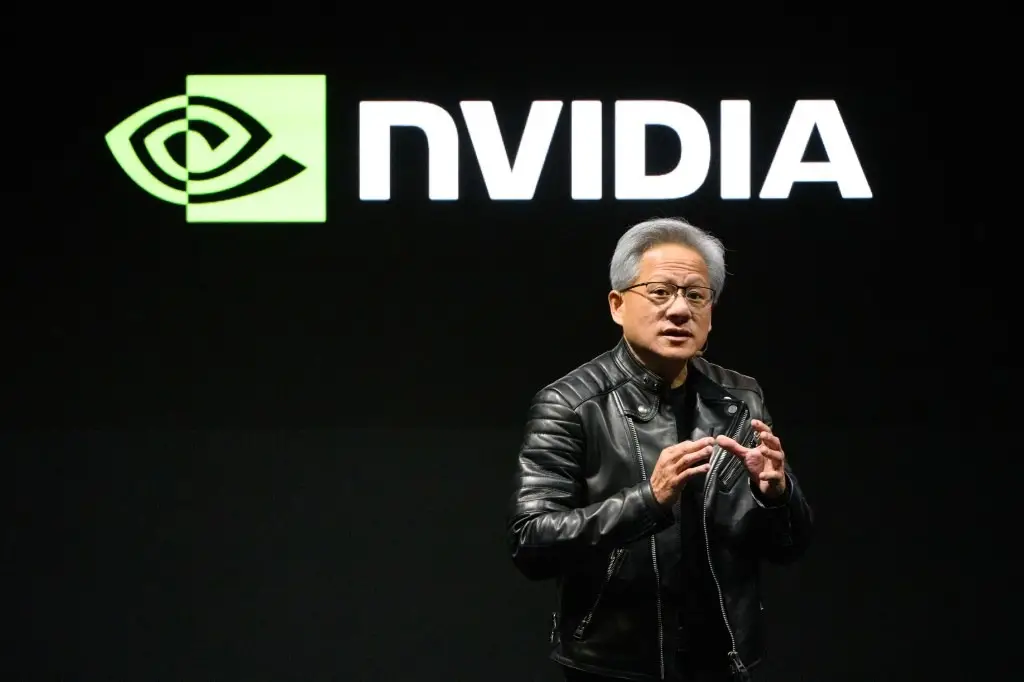

In June 2025, Jensen Huang net worth shot up by $5 billion in a single trading day as Nvidia’s stock price hit its record close of $154.31. The jump increased his fortune to roughly $120 billion and secured Nvidia’s place as the most valuable company in the world with a market capitalization of $3.76 trillion. What caused this surge and why is Huang’s personal fortune so intertwined with the success of the AI chip maker? Let’s explore the backstory, the challenges ahead, and the implications for the AI industry.

Jensen Huang Net Worth Surges as AI Drives Nvidia Growth

Jensen Huang co-founded Nvidia in 1993. Over the years, he built the company into the leader in computer graphics hardware and advanced chips that support artificial intelligence workloads. Every time Nvidia hits a new record high, Huang’s substantial equity stake means his personal wealth grows in tandem. This most recent spike was driven by soaring demand for Nvidia’s AI-focused chips across data centers, supercomputers, and autonomous machines.

The company’s chips, particularly its H100 and newer Blackwell architectures, have become the de facto standard for training and running large language models and other AI workloads. Nvidia’s quarterly earnings reports show over 50 percent year-over-year revenue growth, bolstering investor enthusiasm and helping drive up its stock price — and Huang’s net worth along with it.

Challenges From Export Controls and Competition

Despite this strong growth and record-setting share price, Huang and Nvidia face some significant hurdles. US export restrictions on selling advanced chips like Nvidia’s H20 series to China have limited one of its largest potential markets. Analysts estimate the company could lose up to $8 billion in Chinese sales annually due to these restrictions. Huang himself voiced frustration at the company’s shareholder meeting, warning that blocking access would slow progress for all parties involved.

Nvidia also faces intensifying competition. Traditional chip giants like Intel and AMD and new players like Chinese tech firms and specialized AI chip startups are all vying to capture slices of this fast-growing market. This competitive pressure underscores the need for continuous innovation at Nvidia, including its next-generation AI hardware and software ecosystems like CUDA, Omniverse, and its autonomous-driving platform.

Impact on Jensen Huang Net Worth and the AI Ecosystem

Huang’s wealth is a reflection of the AI-driven boom that Nvidia has successfully leveraged. Since his fortune is mostly in company stock, every percentage change in Nvidia’s market value translates into billions gained or lost. This link underscores why Huang continues to personally lead Nvidia’s strategic decisions and long-term roadmap.

More importantly, Jensen Huang net worth symbolizes the immense financial value that investors and companies now assign to AI hardware. The AI sector is reshaping data centers, enterprise software, robotics, and even drug discovery. Huang’s company is at the center of this shift because its chips provide the computational horsepower modern AI requires.

For customers like Microsoft, Amazon, Tesla, and Meta, buying Nvidia’s chips is becoming an integral part of their AI strategy. This rising demand is helping Huang and Nvidia reach valuation milestones that even tech giants like Apple and Microsoft struggle to maintain.

Expansion Plans and Future Outlook for Nvidia

Jensen Huang is not content to simply ride the current AI wave. Nvidia is investing heavily in its next-generation chip architectures like Blackwell and future silicon photonics designs to further improve energy efficiency and performance. Huang aims to deepen Nvidia’s software ecosystem so that customers are locked into its proprietary stack, generating recurring software revenue streams alongside hardware sales.

Additionally, Huang is guiding Nvidia into new markets like automotive autonomy and robotics. Initiatives like Nvidia Drive and Omniverse aim to leverage AI simulation and industrial design, positioning Nvidia as a platform player across hardware and software.

As these ventures grow, Huang’s net worth will rise and fall with investor confidence. But given the company’s strong track record of innovation, most analysts remain optimistic. Banks predict AI will continue to attract venture capital and corporate spending for years to come — fueling Nvidia’s top-line growth and Huang’s personal fortune.

Risks and Responsible Leadership

While Huang’s fortune and Nvidia’s valuation skyrocket, some caution is warranted. Rapid growth can draw regulatory scrutiny. Antitrust regulators in the US and Europe already monitor Nvidia’s dominance in AI chips. Huang must also navigate increasing pressure to produce hardware sustainably and ethically as demand grows.

Workforce concerns will also matter. Scaling chip production requires a robust, highly trained global labor force. Huang and Nvidia need to support local talent development through investments in education and training — especially in developing countries where they aim to expand.

Jensen Huang net worth is also tied to his personal credibility. Shareholders look to him for transparent communication about Nvidia’s long-term plans and ethical practices. Given his close identification with the company, Huang must balance business ambitions with responsible stewardship of capital, people, and technology.

Conclusion

Jensen Huang net worth surged by $5 billion as Nvidia’s stock hit a record close of $154.31, underscoring the company’s critical role in the AI revolution. Huang’s financial success is closely intertwined with Nvidia’s innovation, market strategy, and long-term prospects. By focusing on AI hardware, data center acceleration, and next-generation chip architectures, Nvidia continues to grow into new industries and geographic markets.

But sustaining this momentum will require deft handling of competition, regulation, and sustainability. Investors and customers alike will watch closely as Huang and his team navigate these challenges. Given his track record, most believe Huang can do just that, ensuring that Nvidia — and his own wealth — will remain on an upward path for years to come.

Read More

Tuesday, 24-02-26

Tuesday, 24-02-26