President Prabowo Subianto has confirmed that the recently enacted 12% Value-Added Tax (VAT) will only apply to luxury goods and services, not everyday essentials. This change, which came into effect on January 1, 2025, aims to address economic challenges while protecting the purchasing power of the general public.

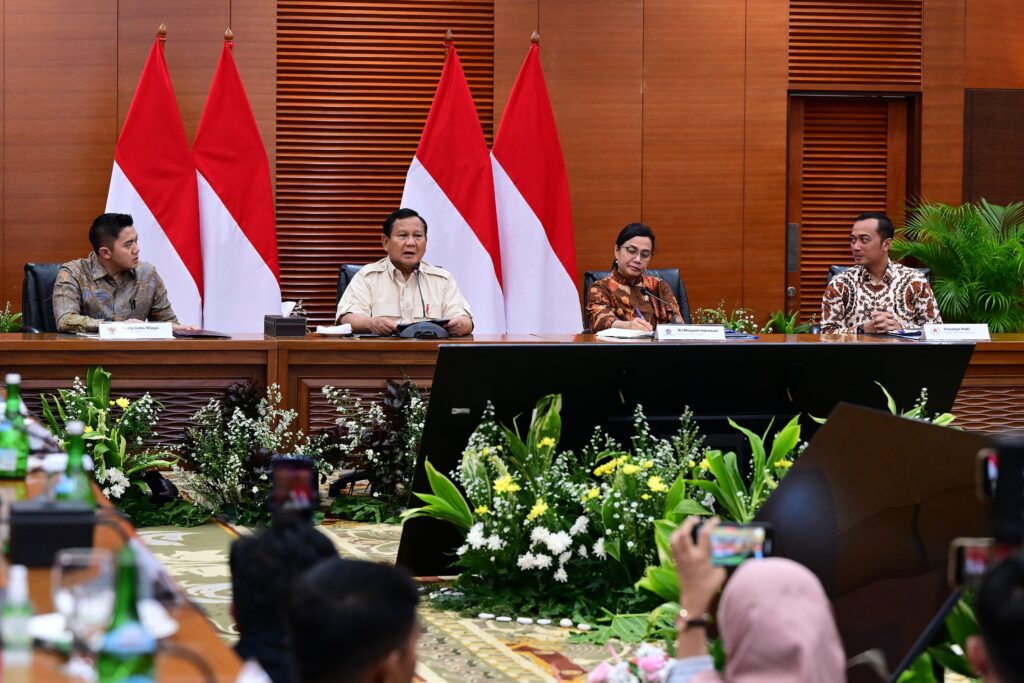

Speaking at the Ministry of Finance in Jakarta on December 31, 2024, Prabowo emphasized that the VAT increase would not impact basic commodities. "Only luxury goods, such as high-end products, will be subject to the new tax," he said. These goods are typically consumed by wealthier groups in society.

The 12% VAT hike targets luxury items such as expensive vehicles, properties valued at over IDR 30 billion, and recreational assets like yachts and private planes. Additionally, it covers luxury residences such as mansions, apartments, and townhouses that fall within this price range. These high-value items have long been subject to luxury goods tax (LGT), which is now adjusted with the new VAT rate.

While the new VAT will primarily affect the wealthy, essential goods like rice, meat, eggs, vegetables, and fresh milk, as well as public transport and basic housing, will remain exempt from VAT. This exemption aims to protect the broader population from price increases on daily necessities.

Prabowo also addressed global economic challenges, stressing the government's cautious financial management amidst uncertainty. Despite rising commodity prices and strained state revenues, Indonesia has managed to maintain fiscal discipline, keeping the budget deficit under control.

To support the population, especially low-income households, the government has allocated IDR 38.6 trillion for 15 economic stimulus packages. These incentives will focus on assisting low- and middle-income groups, as well as small businesses, with particular attention to protecting micro, small, and medium enterprises (MSMEs).

Furthermore, the Ministry of Finance issued a decree (Peraturan Menteri Keuangan Nomor 131 Tahun 2024) outlining the luxury goods that will be taxed under the new VAT rate, confirming that the changes are limited to the luxury sector.

WARTAEKONOMI

Read More

Friday, 27-02-26

Friday, 27-02-26