Digital banks such as Krom Bank operate under the supervision of Indonesia’s financial regulators. The Financial Services Authority (OJK) and Bank Indonesia (BI) oversee Krom Bank’s operations. In addition, Krom Bank is a member of the Indonesia Deposit Insurance Corporation (LPS), allowing customers to save funds securely.

A Legacy of Transformation: From Bank Ekonomi to Krom Bank

Krom Bank was established in 1957 in Bandung, West Java, under the name Bank Ekonomi Nasional. It changed its name multiple times—Bank Pengembangan Nasional in 1976, Business International Bank in 1995, and PT Bank Bisnis Internasional in 1996.

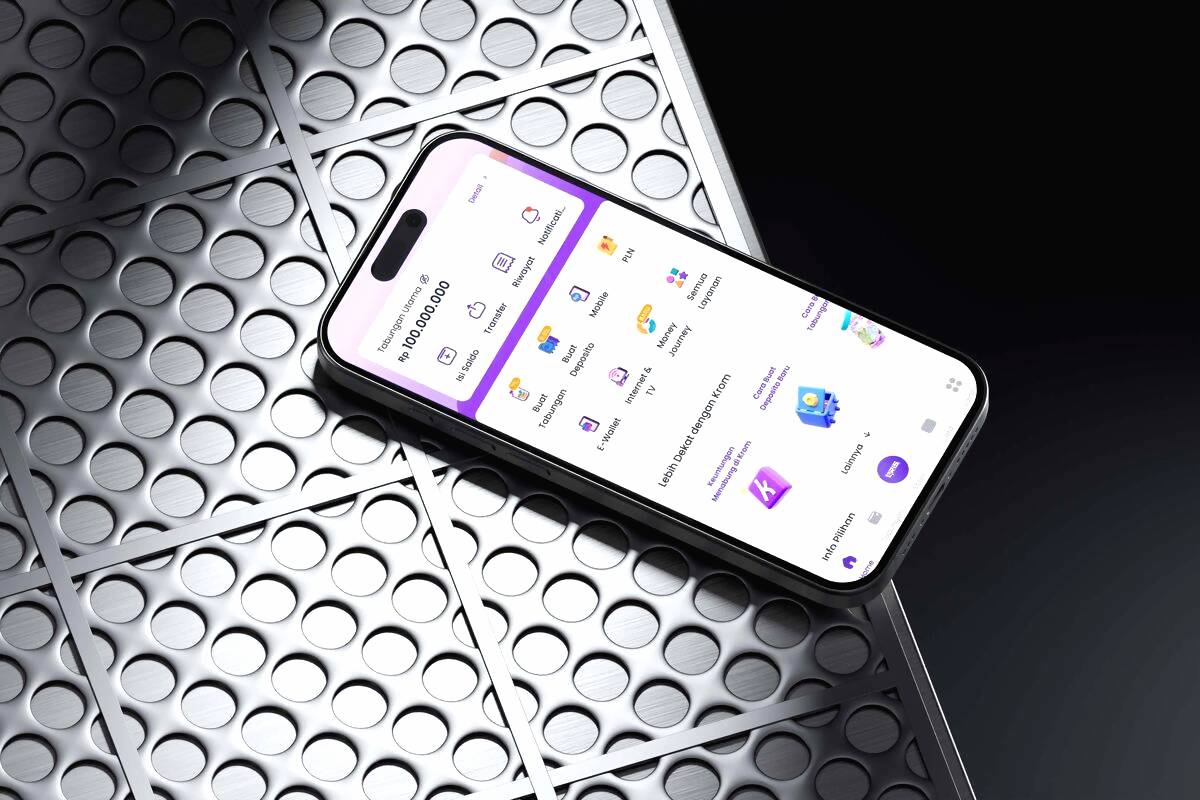

In 2020, the bank launched its initial public offering under the code BBSI. PT FinAccel Teknologi Indonesia became one of the shareholders in 2021. In 2022, the company transformed the bank into a digital institution under the name PT Krom Bank Indonesia Tbk. By 2023, the Krom app was launched, offering digital banking services that are simple, secure, flexible, and beneficial.

Regulatory Compliance and Customer Protection in Digital Banking

President Director Anton Hermawan stated that Krom Bank consistently adheres to applicable regulations in all business activities. According to him, customer protection is a top priority and part of corporate governance.

“Krom Bank adopts strong Good Corporate Governance (GCG) principles, where the compliance function plays an independent and strategic role to ensure all internal policies align with the regulatory framework set by OJK, Bank Indonesia, and LPS,” Anton explained in a written statement.

Krom Bank ensures transparency in its product information through its application, allowing customers to access details about interest rates, fees, and potential risks.

The bank also provides a structured, effective, and responsive customer complaint system that follows OJK’s time standards. In terms of security and reliability, Krom Bank follows BI standards for smooth and secure digital services, as well as prudent transaction management.

Customer Data Protection and International Security Standards

Krom Bank prioritizes customer data security as a foundation of trust. The bank implements a comprehensive Information Security Governance framework that binds both employees and third parties. This approach complies fully with Indonesia’s Personal Data Protection Law (UU PDP).

“Management sees data security not as a cost, but as a strategic investment to maintain the bank’s integrity and reputation,” Anton said. He added that the bank is committed to ongoing investment in modern security technologies and human resource development through regular cybersecurity training and threat awareness.

To support this commitment, Krom Bank has obtained ISO/IEC 27001 certification for its Information Security Management System and ISO/IEC 27701 certification for its Privacy Information Management System. Anton added, “This includes customer data protection. Management also applies the principles of privacy by default and privacy by design as part of the personal data protection governance.”

Financial Performance and Interest Rates That Exceed Guarantee Limits

As a participant in LPS, Krom Bank operates under the deposit insurance scheme. As of October 1, 2025, LPS set the guaranteed deposit interest rate for commercial banks at 3.5% per year. Krom Bank offers savings interest rates of 6% per year and deposit interest rates up to 8.25% per year.

Customers can access detailed product information and the associated risks through the Krom app.

Since the Krom app launched in early 2024, the bank has recorded a net profit of IDR 124 billion. Krom Bank maintains financial stability and profitability, as seen from its growing assets, third-party funds (DPK), and earnings.

The bank continues adjusting its strategies to ensure liquidity adequacy, financial system stability, and sustainable intermediation. As of June 2025, Krom Bank reported a Liquidity Coverage Ratio (LCR) of 1,463%, well above the OJK’s minimum requirement of 100%.

“ This indicates that Krom Bank’s liquidity adequacy is very sufficient and able to meet liquidity needs,” Anton said.

PHOTO: KROM BANK/RRI

This article was created with AI assistance.

Read More

Wednesday, 04-03-26

Wednesday, 04-03-26