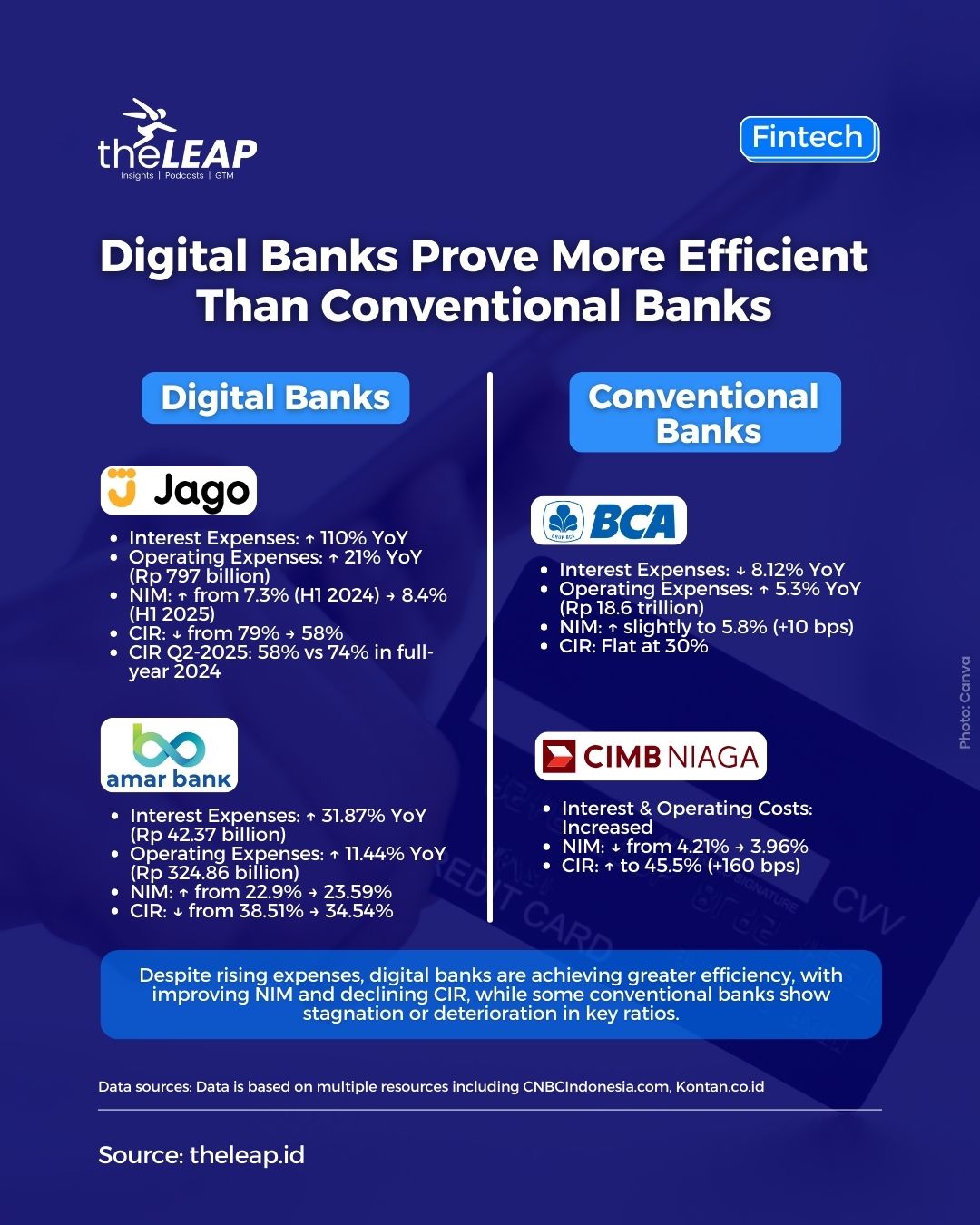

Digital banking in Indonesia increasingly shows more efficient performance than conventional banks, as reflected in key financial ratios such as Net Interest Margin (NIM) and Cost to Income Ratio (CIR).

These ratios indicate better margin management and operational cost control despite rising expenses.

PT Bank Jago Tbk reported a 110% year-on-year increase in interest expenses by June 2025, with operational costs rising 21% to Rp 797 billion.

Yet, Bank Jago’s NIM rose from 7.3% in the first half of 2024 to 8.4% in 2025. Its CIR also dropped from 79% to 58%, showing improved efficiency.

Similarly, PT Bank Amar Indonesia Tbk’s interest expenses grew 31.87% to Rp 42.37 billion, but its NIM increased from 22.9% to 23.59%. Amar Bank’s CIR fell from 38.51% to 34.54%.

Conventional Banks Show Different Efficiency Trends

PT Bank Central Asia Tbk (BCA) saw interest expenses decline 8.12% year-on-year, while its NIM increased slightly by 10 basis points to 5.8%.

Operational costs grew 5.3% to Rp 18.6 trillion, and CIR remained stable around 30%.

PT Bank CIMB Niaga Tbk experienced a decrease in NIM from 4.21% to 3.96%, alongside a CIR increase of roughly 160 basis points to 45.5%. These shifts were due to rising interest and operational expenses.

Industry Leaders on Efficiency and Investment

Bank Jago’s Director of Finance, Technology & Operations, Supranoto Prajogo, explained that rising operational costs align with business growth and new product development.

“This increase in operational costs is natural due to ongoing new initiatives,” he said. However, operational income grew faster than costs, improving net operational income and lowering CIR. “This shows increasingly efficient operations,” he added.

BCA’s EVP Corporate Communication & Social Responsibility, Hera F. Haryn, noted that BCA’s half-year profit in 2025 was supported by interest and non-interest income and controlled operational expenses.

“BCA optimizes income from all business lines and increases operational efficiency while maintaining service quality,” she said.

CIMB Niaga’s President Director, Lani Darmawan, said their CIR remains within internal healthy guidelines near 45%.

“We ensure investment costs continue, especially for digitalization, cybersecurity, data & IT security, and improving human resources,” she said.

This article was created with AI assistance.

Read More

Saturday, 28-02-26

Saturday, 28-02-26