In a significant shift within global manufacturing, China has overtaken Germany in robot usage, according to the latest annual report by the International Federation of Robotics (IFR). The data highlights the increasing role of automation in industrial processes, particularly in China, which has invested heavily in robotic technologies to enhance its manufacturing capabilities.

The IFR report focuses on robot density, a key metric for comparing the level of automation across different countries. South Korea remains the global leader with 1,012 robots per 10,000 workers, reflecting a steady 5% annual increase since 2018. Singapore follows closely behind, and China has now secured the third position globally, surpassing Germany with 470 robots per 10,000 workers. This marks a significant jump for China, which had just 230 robots per 10,000 employees in 2019, highlighting the rapid pace of automation adoption in the country.

Germany, traditionally known for its strong industrial base and as a leader in manufacturing automation, now ranks fourth with 429 robots per 10,000 workers, maintaining a steady 5% annual growth rate since 2018. Despite this consistent progress, Germany now faces significant challenges as it confronts increasing competition from China, particularly in sectors where automation is crucial for cost efficiency and productivity.

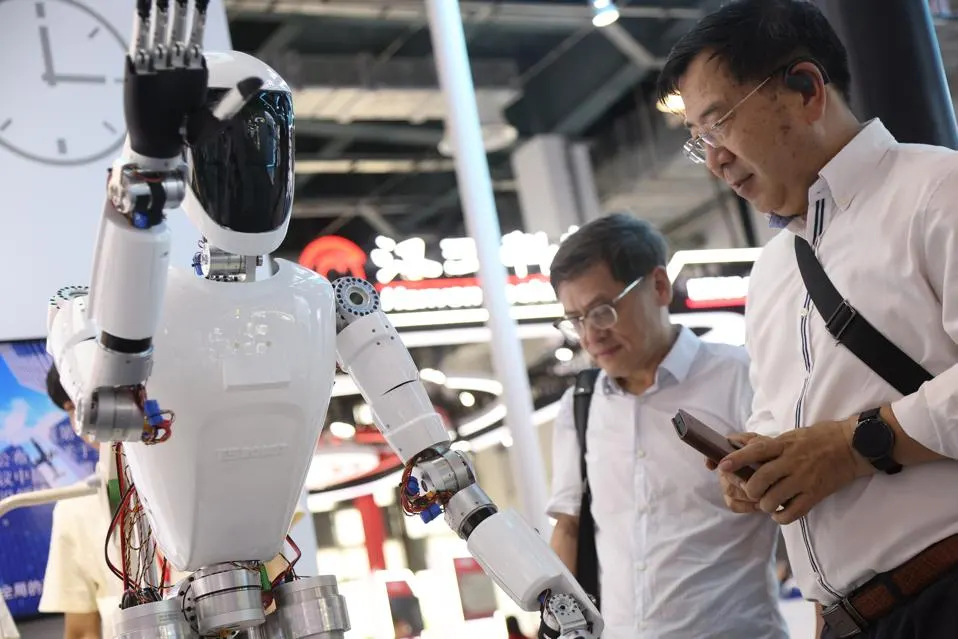

China’s swift rise in industrial robot usage can be attributed to massive investments in automation technology, supported by both government initiatives and private sector innovation. The country’s emphasis on robotics has allowed it to streamline manufacturing processes, reduce reliance on human labor, and increase production efficiency across various industries. This growing automation has made China more competitive, especially in sectors such as electronics, automotive, and textiles.

For Germany, this shift presents both challenges and opportunities. The country has long relied on its industrial base, with a focus on high-quality manufacturing and exports. However, as China’s industrial robots become more advanced and integrated into production lines, Germany’s competitive edge in certain areas is increasingly at risk. With China now leading the charge in automation, Germany’s economy could face a tougher landscape in the coming years, particularly as economic projections for 2024 suggest contraction, making it the worst performer among the G7 nations.

This shift in automation is not only a challenge for German industries but also for Europe as a whole. As China continues to invest in robotics, it could disrupt global supply chains, particularly in manufacturing and export-driven economies. The rise of robotic technologies could also impact the labor market, with workers in traditional manufacturing roles facing increasing pressure from automation.

Germany is already planning responses to these challenges by continuing to invest in its own robotics and AI initiatives, but it will need to accelerate innovation to maintain its competitive position. For businesses and policymakers in Germany and Europe, staying ahead in the automation race will be critical in ensuring future economic growth and competitiveness in the global market.

REUTERS

Read More

Sunday, 01-03-26

Sunday, 01-03-26