JULO, the leading Indonesian fintech company is transforming access to financial products for millions of emerging consumers. By offering innovative digital credit solutions, JULO empowers Indonesians with improved financial tools. As one of the pioneers in data-driven credit underwriting, JULO's mobile app efficiently processes credit applications and assesses creditworthiness, driving financial inclusion across the country.

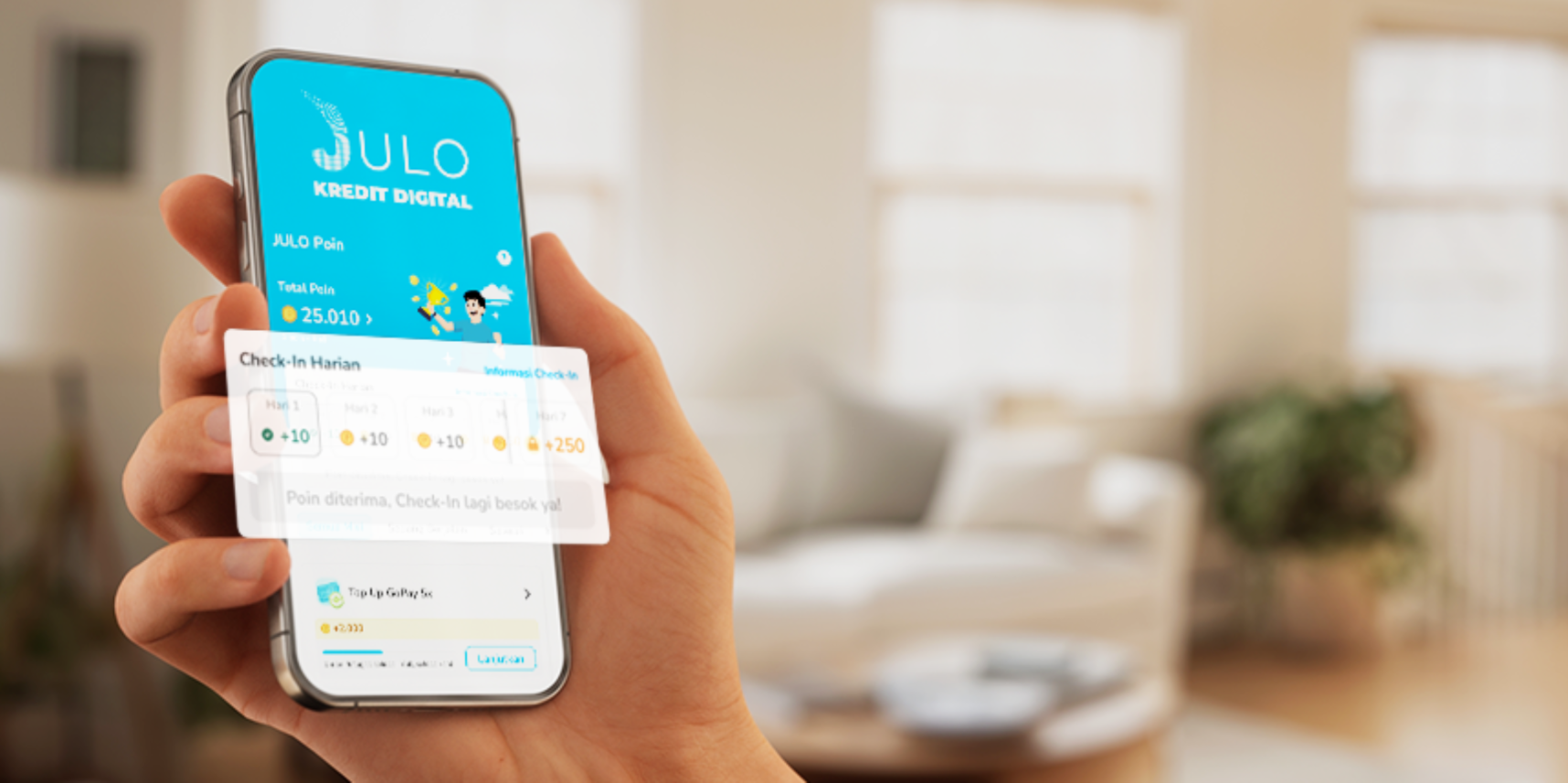

JULO is advancing financial innovation with JULO Poin, a loyalty program offering credit card-like rewards through its accessible digital platform. This initiative supports JULO’s mission to broaden credit access in Indonesia, where only 6% of the population holds a credit card. JULO's unique single-limit feature allows users flexible access to credit, mirroring the ease of traditional credit cards.

JULO Poin not only enhances user experience but also drives loyalty, crucial for JULO’s customer base, where 80% of users are repeat clients. With a transparent 1 Poin = 1 Rupiah system, the program rewards every transaction, enabling users to easily track and maximize benefits. Aligning with JULO’s commitment to financial literacy, it also incentivizes responsible behavior by rewarding early and on-time repayments.

Users can redeem points to reduce installment payments or convert them into e-wallet funds and mobile top-ups, catering to Indonesia's e-wallet preference, with 84% of online shoppers opting for this method, according to the 2023 e-Commerce Consumer Behavior Report. With 106.9 million e-wallet users, JULO Poin meets the needs of digital-savvy consumers by offering various ways to earn and redeem points.

Within three months of JULO Poin's launch in July 2024, about 61% of active users joined, with 100,000 users engaging in September alone, drawn by the program’s easy, single-click redemption process.

“As a financial inclusion provider, our goal is to make every click, swipe, and interaction rewarding and enjoyable to build long-term relationships with our customers,” said Nimish Dwivedi, JULO’s Chief Business Officer. Manoj Awasthi, JULO’s Chief Technology Officer, added that the program’s custom-built system offers an endless range of point options in real-time with high security.

This enthusiasm is echoed by JULO user Agus Kristianto, who shared that he finds JULO Poin more rewarding than other platforms. “It’s easy to earn points, making transactions more enjoyable. So far, I’ve earned over 355,000 points and plan to keep earning to get more rewards.”

JULO’s virtual credit card currently serves over 2 million Indonesians, offering a high limit of up to USD 3,500 for both cash and non-cash transactions like e-wallet top-ups, utility payments, e-commerce, and healthcare. JULO’s flexible credit options distinguish it as a leading fintech provider compared to traditional loans and Buy Now, Pay Later (BNPL) solutions.

Read More

Tuesday, 17-02-26

Tuesday, 17-02-26