Nvidia has reported a strong fourth-quarter performance, driven by soaring demand for artificial intelligence chips, with revenue rising 78% to $39.33 billion. The company also posted a net income of $22.09 billion, up 72% from the same period last year.

In its fiscal year 2025, Nvidia’s total revenue surged 114%, reaching $130.5 billion. This growth is largely fueled by its data center business, which now accounts for 91% of its total sales, a significant increase from 83% a year ago and 60% in 2023. The company’s data center revenue hit $35.6 billion in Q4, marking a 93% annual rise, exceeding StreetAccount’s $33.65 billion estimate.

Looking ahead, Nvidia expects first-quarter revenue of approximately $43 billion, plus or minus 2%, surpassing analyst predictions of $41.78 billion according to LSEG estimates. This forecast suggests a year-over-year growth of 65%, though it marks a slowdown compared to the 262% growth seen a year earlier.

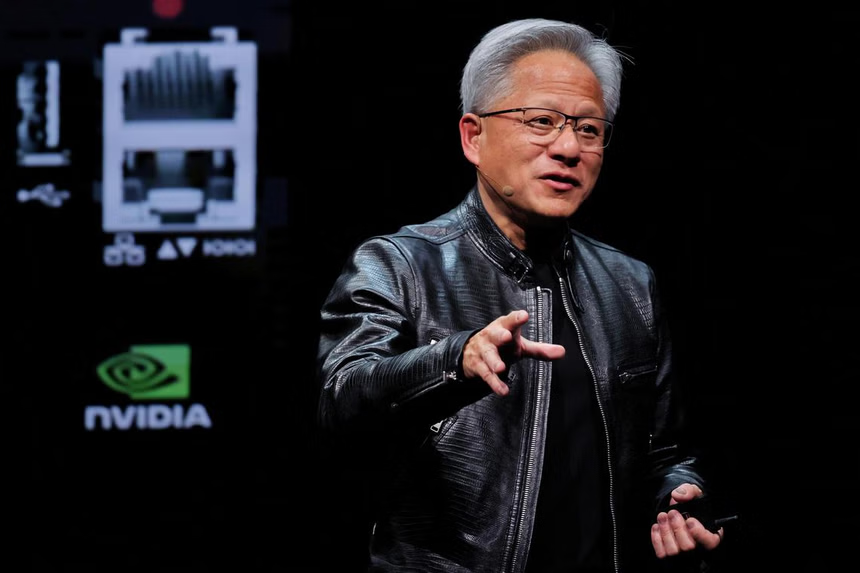

A key driver behind Nvidia's growth is the launch of its Blackwell AI chips. The company reported $11 billion in Blackwell-related revenue during the quarter, with CFO Colette Kress describing the product rollout as "the fastest product ramp in our company’s history." CEO Jensen Huang highlighted strong demand for Blackwell, especially from major cloud service providers, which accounted for around 50% of Nvidia's data center revenue.

Despite Nvidia’s top-line success, the company’s gross margin dropped to 73%, a three-point annual decline due to the higher production costs of its newer AI data center products. The company also guided a lower Q1 gross margin of 71%, falling short of LSEG’s 72.2% consensus.

Investors appeared hesitant initially, with Nvidia's stock remaining flat in aftermarket trading following the earnings announcement. However, shares later climbed 2.76% as confidence grew around the company’s optimistic AI-driven growth trajectory.

Addressing concerns over custom AI chips from tech giants like Amazon, Microsoft, and Google, Huang reassured investors, stating, “Just because the chip is designed doesn’t mean it gets deployed.” Meanwhile, Kress dismissed worries about more efficient AI models, such as DeepSeek’s R1, reducing demand for Nvidia’s chips, explaining that "long-thinking AI can require 100 times more compute per task compared to one-shot inferences."

As Nvidia pushes forward with AI innovation and Blackwell’s expansion, its future performance will depend on how quickly it can scale production and maintain investor confidence in a rapidly evolving market.

PHOTO: REUTERS/ANN WANG

This article was created with AI assistance.

Read More

Friday, 06-02-26

Friday, 06-02-26