BCA Digital, a subsidiary of Bank Central Asia (BCA), announced that its user base surpassed 2.3 million as of November 2024, with deposits reaching Rp11 trillion. The bank’s customer demographic skews heavily toward Millennials and Gen Z, making up 90% of its clientele.

“Within three years of Blu's launch, we have successfully achieved Rp11 trillion in third-party funds,” stated Lanny Budiati, President Director of BCA Digital, during a press conference in Jakarta on December 10, 2024.

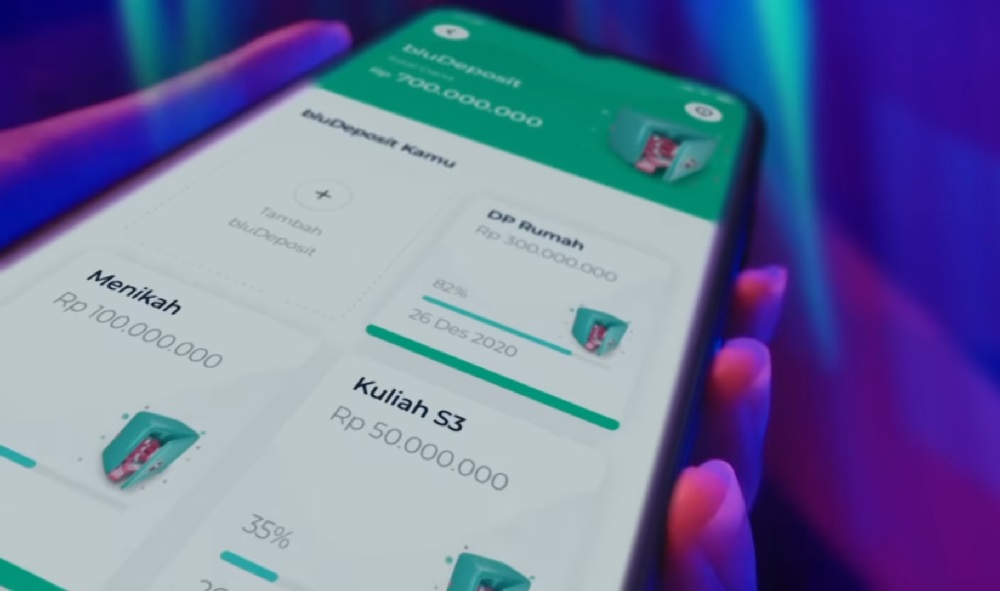

The average balance per account is approximately Rp5 million, indicating a strong spending power among Blu customers. Post-pandemic, a notable trend in travel spending has emerged, prompting Blu to capitalize on this shift by collaborating with Garuda Indonesia. Together, they launched the Garuda x bluDebit Card, Indonesia’s first co-branded debit card between a digital bank and an airline.

This strategic partnership allows Blu users to purchase GarudaMiles directly through the Blu app, while Garuda Indonesia’s FlyGaruda app will integrate Blu’s services. Lanny emphasized, “Collaborations like co-branded debit cards and integrated apps are pivotal in enhancing our service ecosystem.”

BCA Digital has demonstrated robust financial performance in 2024, reporting a profit of Rp71.47 billion as of September 2024, a 529.69% increase from Rp11.35 billion in September 2023. The bank also recorded Rp5.51 trillion in loans disbursed during the first nine months of the year, reflecting a 23.54% year-on-year growth.

This growth underscores Blu’s ability to attract young, tech-savvy users while exploring innovative collaborations to meet evolving customer needs.

BISNIS

Read More

Saturday, 31-01-26

Saturday, 31-01-26