In early 2026 at the World Economic Forum (WEF) in Davos, global economic leaders and analysts sounded urgent warnings about the mounting AI economic bubble risk facing the world economy. Delegates discussed how speculative investment in artificial intelligence (AI) could be creating market distortions that might exceed the severity of the dot-com bubble of 2000, with potentially significant implications for global financial markets, corporate valuations, and economic stability. Emerging concerns focus on asset overvaluation, unsustainable investment flows, and the broader systemic risks tied to AI technologies and associated infrastructure.

This article explores the rise of the AI investment frenzy, comparisons with historical tech bubbles, the drivers of the current speculative cycle, and policy recommendations proposed by economists, investors, and global institutions to mitigate the potential fallout from a bubble-induced market correction.

Understanding the AI Economic Bubble Risk

The term AI economic bubble risk describes a situation in which valuations for AI-related companies, technologies, and assets have become decoupled from underlying economic fundamentals and sustainable profits. Many leading technology firms have seen their market valuations surge based on the promise of future AI-driven growth rather than current earnings or return on invested capital. This environment echoes historical speculative phases such as the dot-com bubble, when investment poured into internet startups before business models were established and profitable.

At WEF Davos, economists highlighted that the rapid scale of AI investment, including in infrastructure like data centers and semiconductor capacities, has elevated asset prices across sectors related to AI. This reflects a broader trend of risk capital seeking high-growth opportunities, often at the expense of traditional valuation metrics. As a result, several experts cautioned that if market expectations around AI’s economic payoff falter, a rapid correction could occur, dragging down valuations that have relied heavily on optimistic forecasts rather than sustainable business outcomes.

The current concerns differ in context from the dot-com era, but the underlying theme remains: investor exuberance can inflate market segments beyond sustainable limits. In the late 1990s, speculative investments in nascent internet firms pushed valuations far beyond the capacity of many companies to actually generate profits. When the bubble burst, the Nasdaq Composite Index lost nearly 80 percent of its value, and many startups collapsed.

Drivers Behind the Surge in AI Investment

Multiple factors have contributed to the rapid buildup of AI investments, reinforcing the perception of a potential economic bubble.

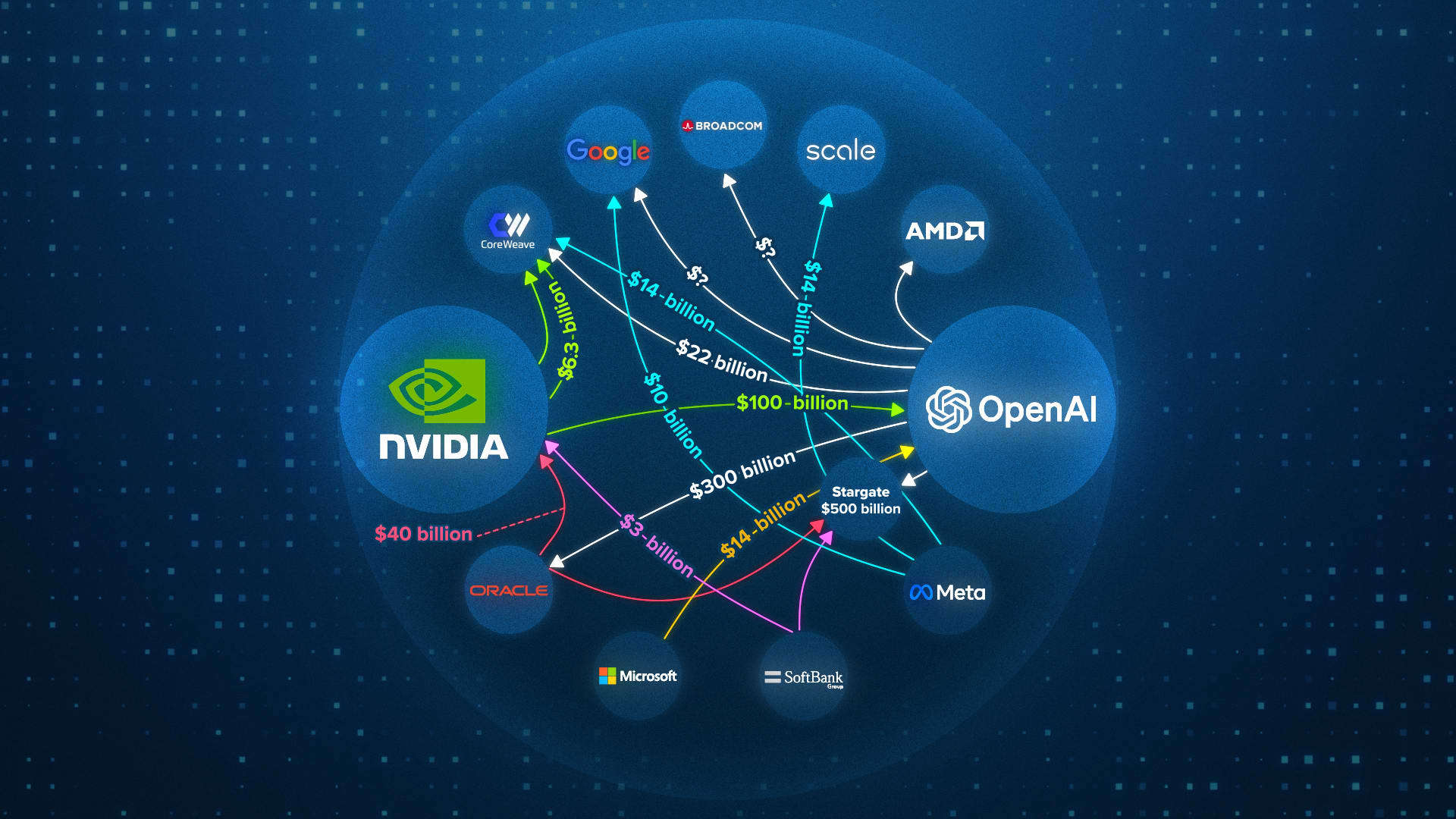

1. Massive Capital Flows and Venture Enthusiasm

Global investors have poured billions of dollars into AI startups, platforms, and related technologies, fueling a surge in valuations that often outstrip revenue generation. The promise of transformative AI capabilities encourages venture capital and private equity to chase growth prospects without necessarily requiring immediate profitability. This dynamic recalls the dot-com era when speculative investments overcrowded the market. Analysts at institutions like the Bank of England and the International Monetary Fund (IMF) have specifically noted overvaluation in AI linked equities, suggesting that market measures in some cases resemble valuation peaks similar to those seen during the dot-com bubble.

2. Valuation Metrics Detached from Fundamentals

One reason investor enthusiasm has persisted is the focus on future potential rather than current financial performance. Many AI companies and platforms have yet to demonstrate sustainable profit margins or clear paths to consistent earnings growth. Despite this, their stock prices have soared on expectations of future adoption and growth. When speculative capital dominates valuation considerations, markets can diverge from reasonable assessment of long-term earnings potential.

3. Infrastructure Investment Pressures

Significant spending on AI infrastructure, including data centers, specialized chips, and cloud services, has become a major part of corporate capital expenditure plans. Some analyses indicate that such investment flows could become a structural drag if ROI fails to materialize as expected. Excessive investment in unproven AI infrastructure risks increasing the fragility of financial systems if future returns lag forecasts.

4. Herding Behavior in Financial Markets

The concentration of capital in a few leading AI technology stocks has also created market dependencies that amplify bubble dynamics. When major indices are heavily skewed toward companies perceived as AI leaders, overall market valuations can become susceptible to shifts in sentiment. If confidence wanes, broad market corrections could follow, especially when speculative valuations dominate.

Comparing AI Risk With the Dot-Com Bubble

Comparisons between the present AI investment environment and the dot-com bubble are both illuminating and nuanced. The dot-com era was characterized by mass investment into internet startups, many lacking clear revenue models. At its peak, the Nasdaq Composite Index saw massive valuation increases before crashing dramatically in the early 2000s. That event underscores how speculation detached from economic fundamentals can create systemic risk.

However, the current AI boom differs in several ways. Many of today’s largest technology firms have established revenue streams beyond AI, diversified business models, and significant cash flows. This contrasts with many dot-com companies that were essentially untested entities with speculative prospects but no tangible profits. These structural differences complicate direct comparisons, but they do not eliminate the risk that AI-linked valuations could contract sharply under certain economic conditions.

Additionally, the scale of capital deployed into AI infrastructure and research is unprecedented compared with the infrastructure investment of the dot-com era. While this underscores robust belief in AI’s long-term value, it also creates vulnerability if infrastructure spending outpaces actual adoption or profitability over time.

Potential Consequences of an AI Market Correction

Should an AI-related market correction materialize, the consequences could extend beyond the technology sector.

Market and Economic Volatility

A rapid revaluation of AI-linked stocks could trigger volatility in global markets. Many investment portfolios and pension funds are heavily exposed to technology stocks, and a significant reprice could erode wealth and investor confidence, especially if it coincides with broader economic headwinds.

Financial Sector Strain

Banks, institutional investors, and lenders exposed to AI valuation risks may face increased pressure. If asset values fall sharply, credit conditions could tighten, potentially influencing lending practices and capital availability across sectors. This could slow broader economic activity and amplify recession risks.

Innovation Slowdown

A market correction might temporarily dampen investment flows into promising but unproven AI ventures. While caution could curtail speculative behavior, it might also slow innovation and delay the commercialization of genuinely transformative technologies. Balancing speculative cooling without stifling innovation will be a critical challenge for policymakers and industry leaders.

Strategies to Mitigate AI Bubble Risk

Global leaders and institutions have highlighted several approaches to mitigate the risks associated with the AI economic bubble.

Strengthening Regulatory Oversight

Enhanced financial oversight to ensure that valuations reflect economic fundamentals can help reduce speculative excess. This may involve improved disclosure requirements, tighter lending standards, and stress tests focused on AI-linked assets.

Encouraging Sustainable Business Models

Investors and corporate leaders are increasingly encouraged to focus on profitability, return on invested capital, and long-term strategic value creation rather than short-term valuation gains. Highlighting sustainable revenue models over hype can reduce market fragility.

Promoting International Coordination

Given the global nature of AI investment flows, international coordination on regulatory standards and risk management practices can foster stability. Global economic forums like the WEF are important platforms for this dialogue.

Conclusion

The AI economic bubble risk represents a significant concern for global financial markets and the broader economy. While AI technologies hold immense promise for productivity, innovation, and economic transformation, unchecked speculative investment could inflate valuations beyond sustainable economic fundamentals. Lessons from past episodes such as the dot-com bubble provide important insights into the dynamics of market exuberance, but unique structural differences in today’s economy complicate direct comparisons.

As global leaders discuss these risks at forums like Davos, policymakers, investors, and corporate executives face the challenge of balancing innovation incentives with financial stability safeguards. Whether the AI investment cycle stabilizes through constructive reforms or transitions through a market correction, understanding and addressing potential bubble risks will remain essential for sustaining long-term economic growth.

Read More

Thursday, 05-03-26

Thursday, 05-03-26