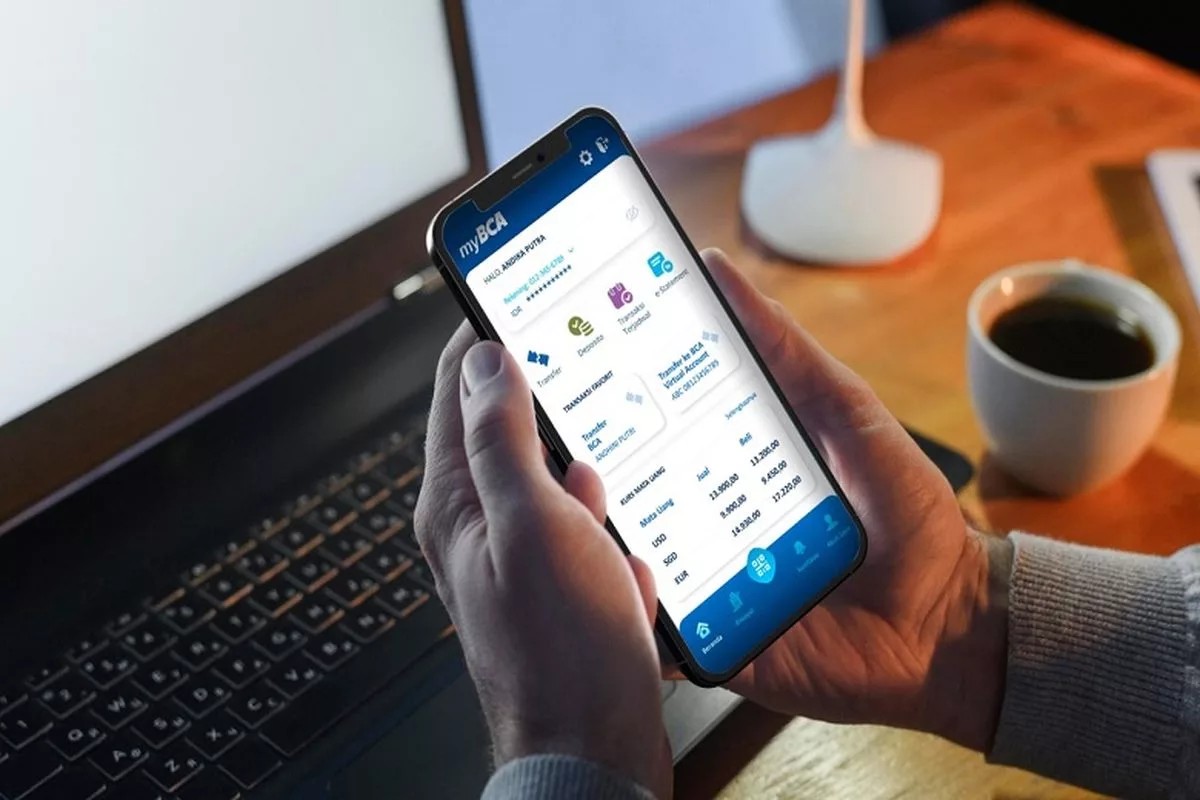

BCA has launched a new feature called Poket Rupiah in the myBCA application, effective (18/12). The feature allows users to manage their finances more easily by creating up to 20 separate savings accounts within a single account.

Poket Rupiah enables allocation of funds for different savings goals in one account. It also includes an auto top-up feature, allowing users to make automatic routine deposits.

Each Poket can be named according to the user’s needs. Users can also set a target amount for each pocket to monitor and reach their savings goals effectively.

Users can lock Poket Rupiah through myBCA to support disciplined saving. In urgent cases, locked Pokets can be accessed via ATMs or BCA branches. Funds can be withdrawn anytime without penalties, ensuring full flexibility.

To use Poket Rupiah, users should update their myBCA application. For more information, customers can contact Halo BCA at 1500 888 or use the haloBCA app.

PHOTO: BCA

This article was created with AI assistance.

Read More

Monday, 16-02-26

Monday, 16-02-26