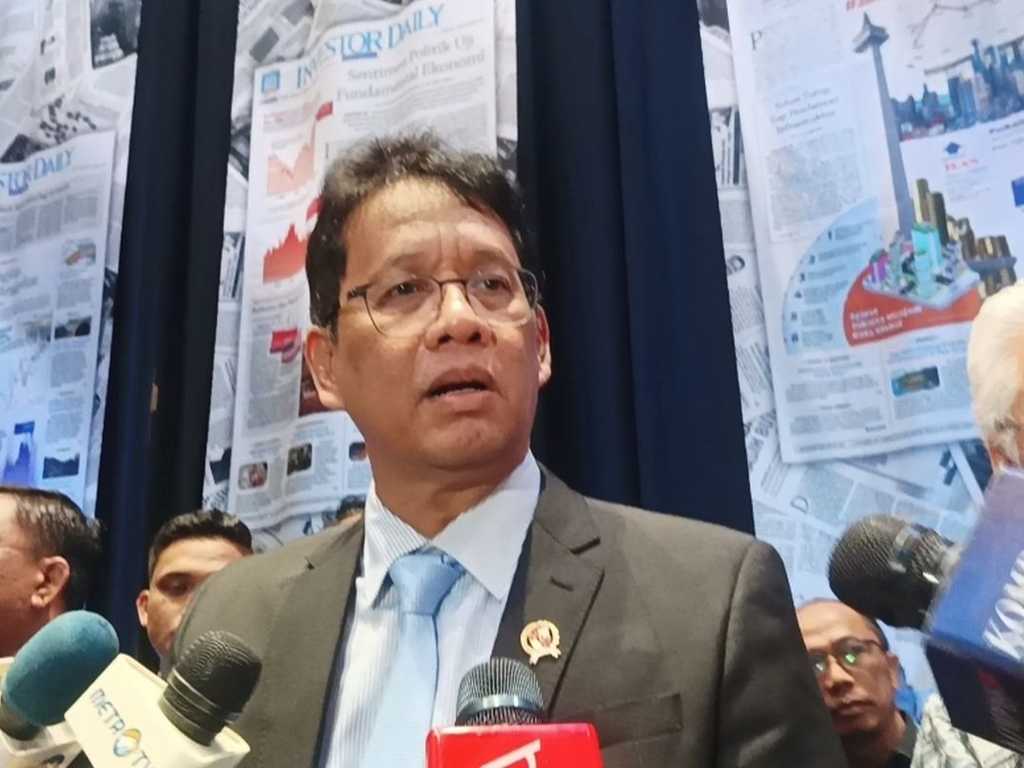

The Indonesian government has officially postponed the implementation of new taxation rules for digital platforms and online merchants until February 2026. This e-commerce tax delay was confirmed after Purbaya Yudhi Sadewa, a senior economic policymaker, addressed public concerns regarding the regulation timeline. The decision reflects an effort to balance state revenue targets with the current condition of Indonesia’s digital economy, which remains uneven in terms of infrastructure, compliance, and market readiness.

Initially, the tax policy related to e-commerce platforms was expected to begin much earlier. However, stakeholders from small and medium-sized enterprises, marketplace operators, and financial authorities argued that enforcement without adequate preparation could create confusion and widen the compliance gap. Purbaya explained that the postponement is not a cancellation, but a calculated move to ensure smoother adoption once the system is fully prepared.

The e-commerce tax delay also comes at a time when Indonesia is still navigating post-pandemic recovery, with digital businesses playing a crucial role in job creation and consumer reach. The Ministry of Finance and related agencies have been tasked with refining technical regulations, simplifying reporting mechanisms, and ensuring that small sellers are not overburdened by administrative requirements. The government believes this additional timeframe will allow more inclusive communication and better coordination among all sectors involved.

Economic and Business Considerations

The decision to introduce an e-commerce tax delay has triggered mixed reactions from business groups and analysts. On one hand, online sellers and marketplace operators welcomed the postponement because it gives them more time to adjust business models, update digital payment systems, and integrate reporting tools. Many small entrepreneurs rely on informal channels and may struggle with immediate compliance if enforcement begins too soon.

On the other hand, economists point out that delaying the tax policy means the government could lose potential revenue that is increasingly important for funding public services and infrastructure. The digital economy in Indonesia continues to grow rapidly, and without effective taxation mechanisms, a large portion of commercial transactions may remain untapped as a source of state income. The e-commerce tax delay therefore presents both relief and risk, depending on the perspective.

Business associations have urged the government to use the delay wisely by building clear guidelines, offering education programs, and ensuring transparency in the classification of taxable entities. They fear that uncertainty could discourage investment or lead to inconsistent enforcement in the future. Some experts have also stressed the need to harmonize policies between central and regional tax authorities to prevent overlapping rules.

Another key aspect involves consumer behavior. The cost structure of online transactions may change once the tax is implemented, potentially affecting pricing strategies. By extending the implementation deadline until early 2026, policymakers aim to avoid sudden changes that could disrupt consumption patterns. Still, the government maintains that the e-commerce tax delay must not be interpreted as deregulation but as a strategic pause to prepare a solid framework.

Policy Outlook And Regulatory Preparation

Going forward, ministries and financial regulators are expected to draft a more comprehensive set of rules that classify different types of digital transactions. Marketplaces, social commerce platforms, logistics providers, and payment gateways may each face distinct reporting requirements. Purbaya emphasized that the goal is not to burden small players but to ensure fairness across the digital economy. The e-commerce tax delay therefore opens a window for better communication and technological integration.

One area of focus is data visibility. Authorities hope to build digital infrastructure that can track transactions with greater accuracy, allowing tax collection to be more transparent and efficient. This approach would help reduce administrative errors and prevent disputes between businesses and tax authorities. The government also plans to collaborate with industry associations to support micro and small merchants who may lack accounting systems or legal guidance.

Public communication will play a crucial role in the months ahead. Without clear information, the e-commerce tax delay could lead to speculation and misinformation, especially among smaller businesses that do not have access to legal experts. For this reason, outreach campaigns and training modules will be essential to promote long-term compliance once the policy takes effect.

Another consideration is how the postponement affects Indonesia’s regional commitments within ASEAN. Several neighboring countries have already implemented digital tax frameworks, and investors will likely observe whether Indonesia’s approach remains competitive. A properly executed e-commerce tax delay can allow Indonesia to align with global standards while preserving local business growth. However, the government must avoid prolonged uncertainty.

Impact On Digital Platforms And Sellers

Online marketplaces have grown into vital platforms for millions of Indonesian sellers. The pandemic accelerated digital adoption, and many micro businesses rely on e-commerce as their primary sales channel. The announcement of the e-commerce tax delay provides breathing room for platform operators to develop better systems for invoicing, data tracking, and user onboarding.

Some large digital companies have already prepared for tax obligations by integrating automated reporting features. They see the postponement as an opportunity to refine those systems and collaborate with the government on best practices. For smaller platforms and individual sellers, the extra time allows them to gather necessary documents and clarify which transactions fall under taxable criteria.

However, the extension also raises questions about fairness. Brick-and-mortar retailers have long been subject to transparent tax obligations, and some worry that further delays could create an uneven playing field. Policymakers have responded by stating that the e-commerce tax delay is only temporary and that fairness remains a key principle of future implementation.

Training and digital literacy programs are expected to expand during the postponement period. By the time the new policy is enforced in 2026, small entrepreneurs should have a clearer understanding of their responsibilities. Authorities hope that reducing confusion early will prevent costly penalties later and improve overall compliance rates.

Conclusion

The decision to delay e-commerce taxation until February 2026 reflects a strategic effort to balance economic growth with regulatory readiness. Purbaya Yudhi Sadewa’s clarification underscores that the e-commerce tax delay is not an abandonment of policy but a step toward more inclusive and effective implementation. While concerns about revenue loss and fairness remain, the additional time provides an essential opportunity to prepare systems, educate stakeholders, and build public trust.

If used effectively, the e-commerce tax delay can support a more transparent, predictable, and equitable taxation framework for the digital economy. Once regulations are finalized, Indonesia will be better positioned to strengthen its fiscal foundation without discouraging innovation and entrepreneurship. Stakeholders across the industry now await further guidance, knowing that the countdown to implementation has simply been extended, not erased.

Read More

Friday, 27-02-26

Friday, 27-02-26