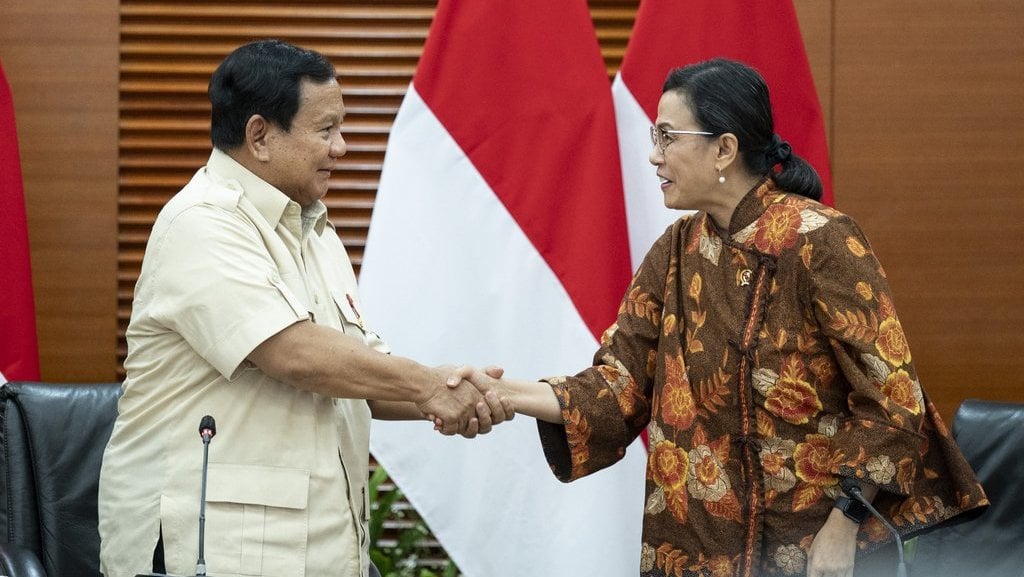

Recent speculations regarding a potential cabinet reshuffle involving Finance Minister Sri Mulyani Indrawati have stirred concerns among investors and market analysts. Such political developments can have profound implications on economic stability, influencing investor confidence, market performance, and the broader economic landscape. This article delves into the potential effects of these rumors on Indonesia's financial markets and economic outlook.

Background on Sri Mulyani Indrawati

Sri Mulyani Indrawati has been a pivotal figure in Indonesia's economic management. Her tenure as Finance Minister has been marked by significant reforms aimed at enhancing fiscal discipline, improving tax collection, and fostering economic growth. Her leadership during global financial challenges has earned her respect both domestically and internationally. Notably, she served as one of the Managing Directors at the World Bank, further cementing her reputation as a seasoned economist.

Market Reactions to Reshuffle Speculations

The mere speculation of Sri Mulyani's potential removal or resignation has had immediate repercussions on Indonesia's financial markets:

- Stock Market Decline: Indonesia's main stock index experienced a sharp decline of 7% on March 18, 2025, marking its lowest point since 2021. This downturn was attributed to concerns over the nation's economic health, exacerbated by declining consumer spending and apprehensions about the continuity of fiscal policies in the event of a cabinet reshuffle.

- Currency Depreciation: The Indonesian rupiah depreciated by approximately 2% against the US dollar, reflecting heightened investor anxiety and reduced confidence in the country's economic stability.

- Trading Halts: The significant sell-off led to a temporary halt in trading activities, underscoring the volatility and sensitivity of the markets to political developments.

Investor Sentiment and Economic Implications

Investor sentiment is closely tied to political stability and the perceived competence of key economic policymakers. Sri Mulyani's potential departure raises several concerns:

- Policy Continuity: Investors fear that her exit could lead to shifts in fiscal and monetary policies, creating uncertainty about the future economic direction.

- Economic Reforms: Ongoing and planned reforms may face delays or alterations, affecting sectors reliant on these policy changes.

- Foreign Investment: Uncertainty can deter foreign investors, leading to capital outflows and reduced foreign direct investment, which are crucial for Indonesia's development projects.

Historical Context of Political Changes and Market Responses

Indonesia's financial markets have historically reacted sensitively to political shifts:

- 2010 Resignation: Sri Mulyani's resignation in 2010 to join the World Bank led to a 3.8% drop in the Indonesia Stock Exchange and a nearly 1% depreciation of the rupiah against the dollar, highlighting her influence on market confidence.

- 2024 Election Uncertainty: In the lead-up to the 2024 elections, markets exhibited volatility due to uncertainties surrounding the election outcomes and potential policy changes.

Government's Response and Communication

Effective communication from the government is vital to mitigate market fears:

- Clarifying Intentions: Addressing rumors promptly can prevent misinformation and reduce speculative trading.

- Reaffirming Commitments: Assuring stakeholders of the continuity of key economic policies can stabilize investor confidence.

- Engaging with Investors: Open dialogues with domestic and international investors can provide clarity and reinforce trust in the government's economic agenda.

Potential Outcomes and Strategies for Stability

Depending on the government's actions, several scenarios could unfold:

- Maintaining the Status Quo: Retaining Sri Mulyani could reassure markets, leading to a potential rebound in stocks and currency value.

- Orderly Transition: If a reshuffle occurs, appointing a successor with a strong track record and ensuring a smooth transition can minimize disruptions.

- Policy Continuity: Emphasizing the continuation of current economic policies, regardless of personnel changes, can help maintain market stability.

Conclusion

The speculation surrounding Finance Minister Sri Mulyani Indrawati's position underscores the intricate link between political developments and economic stability. Her leadership has been instrumental in guiding Indonesia's economy through various challenges. As such, any potential changes in her role necessitate careful management and clear communication to uphold investor confidence and ensure the continued growth and resilience of Indonesia's economy.

Read More

Friday, 27-02-26

Friday, 27-02-26